EBF 200

Lesson 1 - Thinking About Economics

Lesson 1 Overview

Did you complete the course orientation?

Before you begin this course, make sure you have completed the Course Orientation in Canvas.

An Overview of Lesson 1

Did you ever wonder why engineers typically earn more money than short-order cooks, or how the price of gasoline gets established? Why is it that so many Americans drive to work, but lots of people in Britain take the train, and many Dutch ride their bicycles? Speaking of cars, why do we have so many choices when we want to buy a car, but so few choices if we want to buy cable TV or home Internet service? And why is it that if I want to buy a car, I have to go to a dealership, but I can buy a computer directly from Dell (although I don't have to)? On a more personal note, do you ever stop and think about what you choose to spend your money on? Do you choose to spend more of your income on entertainment than, say, a nicer car? Why don't you do both?

These are all questions that can be answered (or, at least, better understood) by using economic analysis. In this lesson, we will talk about some of the basic underlying principles that guide economics as a way of looking at the world.

What will we learn?

By the end of this lesson, you should be able to:

- list and describe the axioms that underlie the "economic way of thinking";

- describe the economic definition of scarcity;

- define what an "opportunity cost" is;

- tell the difference between a positive and normative question;

- list and describe what is contained in a property right.

- explain what economists mean by the terms "utility" and "monetization".

- What are Gregory Mankiw’s ten fundamental principles of economics?

What is due for Lesson 1?

This lesson will take us one week to complete. Please refer to Canvas for specific timeframes and due dates. There are a number of required activities in this lesson. The chart below provides an overview of those activities that must be submitted for this lesson. For assignment details, refer to the lesson page noted.

| Requirements | Submitting Your Work |

|---|---|

|

Reading: Chapters 1 and 2 in Gwartney et al., OR Chapters 1 and 2 in Greenlaw et al. |

Not submitted |

| Lesson Homework and Quiz | This will be submitted via Canvas |

Questions?

If you have any questions, please post them to the online discussion forum in Canvas.

A Desert Island Economy

I am tempted to start the course by trying to say "what economics is" and so on, but it is perhaps easiest to start with a simple illustration.

Imagine you are on a desert island. There are two things you can eat on this island: coconuts and fish. If you wish to survive, you spend all of the available daylight trying to catch fish or harvest coconuts from the palm trees. We can assume, for the time being, that all of your day is taken up doing one of these two things. You need to divide your day between gathering coconuts and catching fish since a diet of just one or the other is not healthy. Suppose you have 10 hours a day to work. It takes you one hour to catch a fish and climbing a tree to get a coconut takes half an hour. So, in 10 hours you can catch 10 fish, or you can gather 20 coconuts. You could also do a bit of both: maybe spend 8 hours fishing and 2 hours getting coconuts, which would give you 8 fish and 4 coconuts. After a few weeks on the island, you settle on a balance whereby you spend 7 hours a day catching fish and 3 hours harvesting coconuts. This gives you 7 fish and 6 coconuts per day. If you want more fish, you have to give up some coconuts, and if you want more coconuts, you have to give up some fish, because there are only a certain number of hours in a day, and you can't make more daylight!

Now, what if it turns out that you are not alone on this island. Suppose there is a person who happens to go by the name "Friday." He's been on the island a long time and has gotten good at fishing. It turns out that he can catch a fish in 20 minutes, but it also takes him half an hour to climb a tree and harvest a coconut. Friday has gotten into a routine where he fishes for 4 hours a day, catching 12 fish, and he harvests coconuts for 6 hours, getting 12 coconuts per day.

This is getting a little complicated, so we'll summarize:

- You: 7 fish, 6 coconuts per day.

- Friday: 12 fish, 12 coconuts per day.

- Total: 19 fish, 18 coconuts.

Now, let's suppose that one day, you and Friday meet up for the first time. After a bit of discussion, you start talking about food, and how much food you get each day. You both work 10 hours per day and get a total of 19 fish and 18 coconuts.

What if I said that it was possible for both of you to get more fish and more coconuts, and neither of you had to work longer hours? Is this magic? Well, not quite.

Let's say you decided to spend all of your day harvesting coconuts, meaning that you were able to get 20 in a day.

At the same time, Friday spends 8 hours fishing. He is able to catch 24 fish and gets 4 coconuts in the other two hours.

Now, between the two of you, you have 24 fish and 24 coconuts. You have more fish AND more coconuts

So, collectively, you are better off. However, neither of you likes the proportion of things you have yourself. You have too many coconuts and not enough fish. Friday does not have enough coconuts. What you can do then is make a trade. Let's say you trade away 10 coconuts in exchange for 10 fish. Now you have 10 coconuts and 10 fish. Friday has 14 coconuts and 14 fish.

Let's summarize:

- Before you meet, 7 fish and 6 coconuts.

- After you meet, 10 fish and 10 coconuts.

Friday:

- Before you meet, 12 fish and 12 coconuts

- After you meet, 14 fish and 14 coconuts.

So, after meeting, you both have more fish and more coconuts. How has this happened? Is this some kind of magic? As I said before, not quite.

The above story may seem a little simplistic - it is - but it powerfully illustrates some important topics that we talk about in the field of economics. What has happened? Well, the first thing that happened after the meeting of you and Friday is that you decided to specialize. You decided to do what you are good at - gathering coconuts. Friday concentrated most of his time on what he is good at - catching fish. By focusing on what you are each good at, you became more efficient. You then decided to trade. Specialization and trade made you both better off and made the sum of the two of you better off.

Complicated? Of course! So, let’s do some more examples.

Example: Comparative Advantage and the Robinson Crusoe Economy

- Robinson Crusoe is stuck on a desert island to fend for himself. He can gain two goods, fish and coconuts.

- In any one day, he can gain 0 coconuts and 8 fish, 1 C and 6 fish, 2 C and 4 fish, and so on down to 4 C and 0 fish. In mathematical terms, Rob can get , where C stands for coconut and F for fish (C and F non-negative). Rob maximizes his happiness, and let us assume (somewhat arbitrarily) that he chooses 3 C and 2 F.

| Rob's Choice | Coconuts | Fish |

|---|---|---|

| #1 | 0 | 8 |

| #2 | 1 | 6 |

| #3 | 2 | 4 |

| #4 | 3 | 2 |

| #5 | 4 | 0 |

What is Rob's opportunity cost of coconuts? 2 fish

What is Rob's opportunity cost of fish? 0.5 coconuts

Rob Meets Friday

It turns out that Friday is living on the other side of the island. Friday has a "production function" such that .

| Friday's Choice | Coconuts | Fish |

|---|---|---|

| #1 | 0 | 4 |

| #2 | 1 | 3 |

| #3 | 2 | 2 |

| #4 | 3 | 1 |

| #5 | 4 | 0 |

Living by himself, Friday chooses 2 C and 2 F.

What is Friday’s opportunity cost of coconuts?

Of fish?

Can Rob and Friday make each other better off?

YES, THEY CAN.

- Assume (for example) Friday makes only coconuts: 4C and 0F. Rob makes 1C and 6F. (So, they specialize.)

- Now together they have 5C and 6F - more than they had separately.

- Assume Rob trades 2.5 fish to Friday for 2 coconuts. Now, are they both better off?

- Rob now has 3C and 3.5F. Before he met Friday he had 3C and 2F. So, he is better off, since he is greedy, and therefore more goods are preferred to less.

- Friday has 2C and 2.5F. Before he met Rob he had 2 of each. So, he is better off.

- So, both Rob and Friday gain from trading – even though Friday wasn’t better than Rob at anything!

Note the 4 Step Approach

- Figure out each party’s opportunity cost.

- Figure out each party’s comparative advantage.

- Determine which good each party should specialize in, and determine production.

- Have the 2 parties trade to make each better off.

Remember, More is Better Than Less!

Example: Comparative Advantage Rosie and Donald

Rosie O’Donnell and Donald Trump are stuck on a deserted island. Rosie has the production function , where T is the production of turtles and B is the production of bananas. The Donald has production function . If they could not trade with each other, Rosie would choose to produce 3 turtles, and the Donald would produce 13 turtles.

Figure out a possible production/allocation system where both the Rosie and the Donald would be better off trading than not trading.

Rosie has the production function , which implies that each turtle cost 3 bananas. She chooses , which implies that , .

The Donald has production function , which implies that each turtle costs 1/6th of a banana. The Donald chooses , so, .

Turtles are much cheaper for the Donald rather than Rosie (1/6th of a banana vs. 3 bananas). So, Donald should trade turtles with Rosie for bananas.

Many trades/production decisions are possible.

Assume Rosie makes all bananas. Since for her, , she makes 20 bananas.

If Donald makes all turtles, he makes 25 turtles.

So, we now have .

Without trade , . So, now we have more production of each.

So, now assume that The Donald trades 6 turtles for 5 bananas.

The Donald now has , . Before, he had and . So, he is better off because he has more of both.

Rosie now has and . Before, she had , . So, she is better off.

Both parties gain from trading!

Practice Exercise

Eric and Rod are stuck on a desert island. There are two goods, fish (F) and coconuts (C). Eric has production function , and without trading chooses . Rod has production function and without trading chooses . Explain an arrangement that can make both better off. Make sure you don’t fall into the trap!

The same idea holds for more complicated scenarios involving more than two people and more than two goods. If people in a society decide to specialize and make a lot of what they are good at making, and then trade some of the things that they make for other things they want, then both they and the society they are part of will be better off. Or, as I will say a little later on, specialization and trade generate wealth for society.

This is perhaps not hard to understand. We all specialize in something and sell it and use the proceeds of that sale to buy other things. A university professor specializes in teaching students and generating research. The university pays the professor for this, and with his wages, he buys food, housing, transportation, clothing, leisure, and many other things. He is better off doing this than trying to make his own food, build his own house and manufacture his own car. A construction company might build a hundred houses a year, which is more than the owners of the company need. So, they sell some of those houses to buy the other things they need to live. This is how our society is organized.

As a society, we have much more wealth because we arrange our societies this way. Without trade (that is, buying and selling things), we would each have to be a fully self-sufficient unit, and each of us would have much less in such a world. We do not trade because we like each other or even care about each other - we usually don't even know the people we are trading with - but we do so because it is in our own best interest. This curious fact - a society of people, each acting in their own best interest (or out of selfish motives), leads to an increase in the wealth of society as a whole - was first written down and expounded upon by Adam Smith, the author of a book called The Wealth of Nations, which was written in 1776 and was the founding text of modern economic thought. We'll talk a bit more about Smith later.

Now, given this simple example as an introduction, we can move on to start talking about economics in a bit more of a formal and structured manner.

What is Economics?

Reading Assignment

Please note that we will not go into further detail in the course notes on budget constraints or production possibilities frontiers, and therefore this material will not be on any quizzes or tests.

Economics is a social science. What exactly does that term mean? "Social" means that is about examining the way the people organize their interactions with each other in societies. "Science" means that the "scientific method" is used as a way of thinking about and studying social organization. We have some other social sciences, such as sociology, anthropology, education, history, and law. These disciplines all look at different aspects of societies or examine them from a certain perspective. Economics is the social science that concerns itself with how people make consumption and production choices in a world of endless wants and limited means.

Economics is not an ideology or a set of political beliefs; it is merely one of the ways in which people try to understand the society we live in, and how it works. It is a way of looking at the world, what we call the "economic way of thinking." This has proven to be a useful tool for understanding and explaining a great deal of human behavior. It explains how people do many of the things they do, and why, and it allows us to predict, with a reasonable degree of confidence, what the effects of some action taken by a government or a group of individuals will be.

Note that I said, "reasonable degree of confidence." That could be taken as a set of meaningless weasel words, with terms like "reasonable" and "confidence" not being clearly defined. However, what I am trying to do when I make this statement is to avoid being too sure about our knowledge of the outcomes. While it is true that people behave in a way that is "generally" predictable, you must always remember that when we study societies, we are talking about people, and people do not uniformly behave in a predictable manner. In mathematical terms, there are too many variables, and we cannot isolate and correct them all. So, what I am saying here is the "soft-sell" on economics: it is a helpful and pretty reliable way of understanding the world, just not a perfect or strictly deterministic way. Note that the "economic way of thinking" has been applied to many other social science disciplines, most famously law and sociology, and it has done a great deal to explain behavior in these areas. If you are interested, you may want to read more about the works of people like Richard Posner in law and economics, and Gary Becker in sociology. Economics also has strong ties to the field of psychology. Several of the recent Nobel Prizes in economics have been awarded to scholars or teams studying economic behavior from a psychological perspective. This should be unsurprising: both disciplines have the goal of trying to figure out how and why people make the decisions and choices that they make.

A great many economics textbooks have been written, and they all strive to start at the same place, laying out what the "fundamental principles" are. One of the best attempts is by Gregory Mankiw, a professor at Harvard University and former chair of the President's Council of Economic Advisors. He has laid out a list of ten "principles of economics" that is broadly accepted as a good summary of the main points that I will try to make here.

Actually, it's more like "7 Principles," because the last three pertain to macroeconomic issues, which is an area of study that will not be addressed in this course. Instead, we will examine microeconomics, which is the study of individual economic actors: people, and firms, and their interactions in markets. Included as an agent in this study will be governments, which play a large role in the economic lives of every individual and every firm.

A good understanding of these seven points will provide you with a very solid grounding for how to think about economic problems throughout this course and throughout the rest of your lives. I will list them below, with some explication. Before I list them, I want to add three "axiomatic" statements that have to be considered before we move on. An axiom is an assumed statement, sort of a "first principle" that is not, or need not be proved. It is a basic understanding of how things happen.

Axiom 1: Things that we want to consume more of are called economic goods or, usually, just "goods". The opposite of a good is a "bad," which is something that we want less of. However, there are very few things that are universally bad - almost every economic bad is somebody else's good. For example, we might think of pollution from burning coal as bad, and it certainly has a detrimental effect on many people, especially those who live near power plants. But the more pollution a plant operator can put into the air, the more electricity he sells, and the more money he makes.

Axiom 2: All goods are scarce. It is important to understand what "scarce" means in this context. There are quite a few words that have one meaning when used in general conversation, and a narrower, more specific definition when used in economic analysis. In general usage, "scarce" usually refers to something that is in short supply, or is running out, or is hard to find. In economics, scarce simply means that something is not limitless. Another way of thinking about it is this: a good is considered scarce if we have to give something up to consume it. When viewed in this light, the phrase "all goods are scarce" makes a bit more sense. Bottles of orange juice or episodes of TV shows are not scarce in the general sense, but they certainly are in the economic sense.

Axiom 3: Wants are unlimited. This is perhaps a polite way of saying "people are greedy" in the sense that people almost always prefer to consume more goods than less. If they reach a limit to how much of some good they want to consume, it is not hard to find another good they would like to consume more of. It is important to consider that things like leisure, rest, and peace of mind can be seen as goods.

Now, moving on to Mankiw's list:

Principle 1: People face tradeoffs.

This means that we have to make choices in a world of unlimited wants and scarce resources. If you want something, you will have to give something else up. You have to make a choice. Perhaps, in a perfect world, we would not have to make choices – we could have all that we want without having to give up anything else, but this is not the world we live in. From the desert island example, we had a simple trade-off: if you wanted more coconuts, you had to give up fish, and vice versa. If you wanted more leisure time, you had to give up some food to get it.

Principle 2: The cost of something is what you give up to get it.

In everyday life, we think of costs generally in terms of money, or perhaps time or effort. However, whenever you make an economic choice, what you give up are all of the choices that you didn’t make. This is what we call an “opportunity cost.” Ask the average man on the street what the cost of a bag of Doritos is, and he will say “99 cents.” Ask an economist, and he will tell you “every other thing that I could have spent 99 cents on." Or maybe, “the most valuable thing I could have spent 99 cents on, but did not because I spent it on Doritos.” Needless to say, this causes a lot of people to avoid having conversations with economists at parties but, nonetheless, thinking about costs in this way helps us better understand economic decision making. This contains a secondary point: money is only a tool, a store of value or a method of accounting. Money is only basically good for one thing: exchanging for goods that we consume. So, the cost of one consumption choice is the most valuable consumption choice we could have had, but chose not to make. Likewise, the opportunity cost of an investment, of either time or money, is the best other investment we could have made with that time and/or money. For example, the opportunity cost of going to an 8 am class is probably an hour of sleep for most people. Once again, think back to the desert island economy: it took you an hour to catch a fish, or half an hour to get a coconut. So what was the cost of a fish? Well, you can look at it two ways: first, you could say that it cost you an hour. This is true, but, really, an hour was only good for one of two things: catching fish or harvesting coconuts. So, if you spent an hour catching a fish, you were giving up two coconuts. We say that the opportunity cost of the fish is two coconuts - 2 coconuts is what you have to give up to gain an extra fish.

Opportunity cost is all the other things you give up to get something else. For example, let’s say you buy a car for 25 thousand dollars. If you don't spend your money on buying the car, you could invest your money (for example: deposit it into a savings account and receive interest or buy stocks, ...). When you buy the car, you give up all the other things that you could have done with the 25 thousand dollars. In economics, you should consider all of those. For example, if investing the money would give you interest, then, the opportunity cost of buying the car would be 25 thousand dollars plus lost interest of given up investment.

Another example: When you are a full-time student, the opportunity cost would be: the tuition that you pay plus money that you could have made if you were working and not spending your time at school.

Another example: Let's assume you are living in Pittsburgh and you want to buy a TV. There is a store in Pittsburgh that sells the TV for 500 dollars. However, you find a store in New York that has a TV on sale for 300 dollars. But there is no shipping service. So, you need to go there and pick it up there. What would you do? The true cost of buying the TV from the store in New York is \$300 plus all the other costs that you don't need to pay if buy the TV from the Pittsburgh store. If you decide to buy the TV from New York:

- You need to rent a car (if you use your own car, you should consider the wear and tear costs of driving to New York and back).

- You need to pay for gas.

- If you work, you need to take a day off and lose the money that you could have earned.

Next is a short video with more explanation.

Video: What is Opportunity Cost? (2:45)

♪ [music] ♪

[Narrator] What is opportunity cost? Opportunity cost refers to the value a person could have received but passed up in pursuit of another option. So if you were to wait in line for free ice cream, you actually give up the opportunity to do something else with your time, like working at a job or reading a book. So that ice cream really isn't free. Economists even use the concept of opportunity cost to determine if people can benefit from trading with one another. Let's look at a simple example -- just two people, Bob and Ann, who produce just two goods, bananas and fish. Because of the concept of opportunity costs, Ann and Bob are worse off when they try to do everything themselves. Here's what Bob can do if he spends all of his time producing only one good. Bob can either gather 10 bananas, or he can catch 10 fish. And Ann can either gather 10 bananas or catch 30 fish. Bob has to choose to gather bananas or catch fish. When he chooses to gather 1 banana, he gives up 1 fish. In essence, Bob trades with himself. He can use that time to gather bananas or trade that time to catch fish, and the cost of that trade is 1 fish per banana. That's Bob's opportunity cost. The same holds true for Ann, but her cost of producing 1 banana is 3 fish. In the amount of time that it takes Ann to gather 1 banana, she could have caught 3 fish. She trades with herself 1 banana for 3 fish. So Bob only has to give up 1 fish to produce 1 banana, but Ann must give up 3 fish to produce 1 banana. Ann's opportunity cost of gathering a banana is higher than Bob's. If Ann and Bob are allowed to trade with one another, they may be able to gain from specialization if Ann focuses on catching fish, and Bob focuses on gathering bananas. Because our time is valuable, any decision we make has a cost. If we focus our time on tasks we're good at, like Ann and Bob, then we end up in a better position than if we try to do everything ourselves.

♪ [music] ♪

To learn more about the role of specialization in trade, click here. Or, to test your knowledge on opportunity cost, click here.

♪ [music] ♪

Still here? Check out Marginal Revolution University's other popular videos.

♪ [music] ♪

Principle 3: Rational people think at the margin.

“Thinking at the margin” means that we think about the next decision we need to make, and the incremental effects of that decision. Put another way, people have to be forward-looking, because the past is in the past, and nothing can be done to change it.

Principle 4: People respond to incentives.

I will talk about this in more depth in the next section when we address rationality and utility maximization. This principle is intuitively very obvious: every child understands the notion of the carrot and the stick: positive and negative incentives designed to modify behavior. A further examination of this topic leads us to discover that people usually act in their own best interest, so when governments design policies, they have to be sure that they are incentivizing the “right” behavior. An interesting topic has arisen recently: the Estate Tax, which is applied to inheritances, is set to be reinstated at the beginning of 2011 after having lapsed at the end of 2009. This means that a wealthy person dying a few minutes after the coming New Year will leave his or her heirs with a significantly larger tax bill than if he died a few minutes before midnight. Thus, the heirs perhaps have an incentive to see to it that a terminally ill parent dies a little bit earlier. This is what is called a “perverse incentive,” because our society generally frowns upon people trying to cause others to die earlier than they otherwise might. Whenever you participate in an economic transaction, it always helps to think about what incentives the other person in the transaction faces.

Principle 5: Trade can make everyone better off.

I might be inclined to make a stronger statement: that trade MUST make everybody better off, but we can go with Mankiw’s weaker statement for now. The fundamental notion behind voluntary trade is that each party is giving up something in exchange for something that they place a higher value upon. If this were not the case, the person would choose to not make the trade. For example, when I buy a bag of Doritos, the shopkeeper will voluntarily make the trade because I am paying him more money than he paid for the chips, so he’s better off, and I will voluntarily make the trade because I get more happiness from consuming the chips than anything else I could spend that 99 cents on. We’re both made better off by the transaction. We will look at applications of this notion in much more depth later on.

Principle 6: Markets are usually a good way to organize economic activity.

This is another statement that could be made a little more forcefully, but we can let it be. Markets refer to institutions (not just places) that allow people to voluntarily and willingly participate in trades to improve their lives. People sell their labor and brain power to firms, which use it to help them make profits for the owners of those firms. People use the money they earn to purchase goods and services to help them live their lives in a way that best makes them happy. In a truly free-market system, we have millions of individual, voluntary economic transactions taking place every day. In reality, sometimes (or, perhaps, always) markets do not work in this idealized manner, which leads to the next principle.

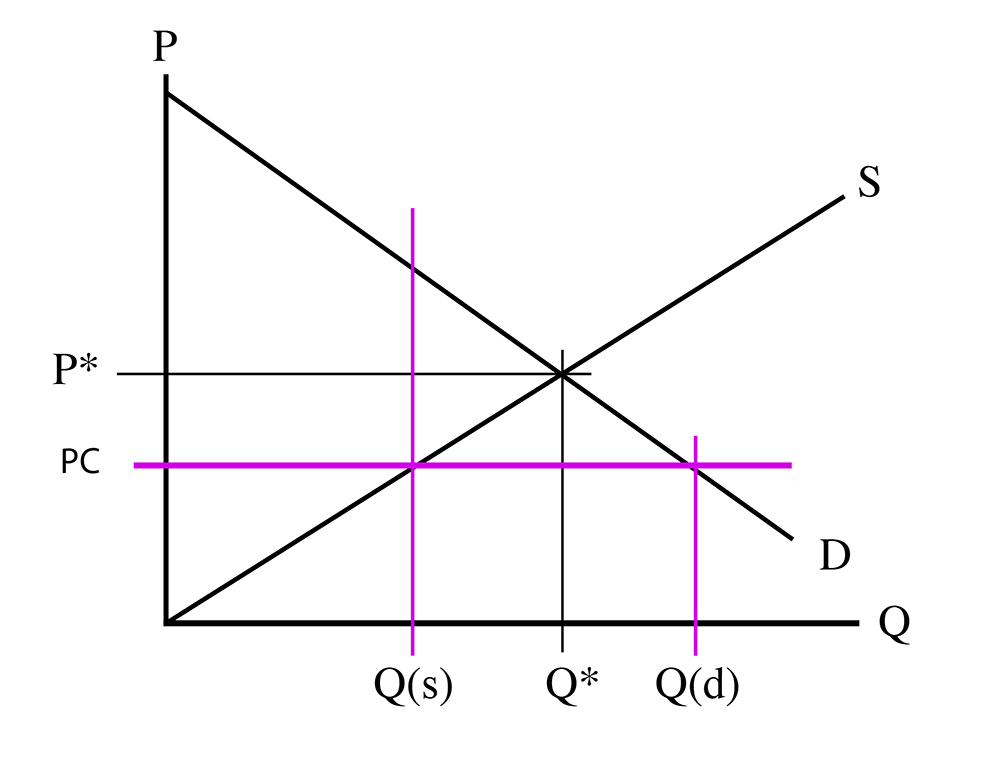

Principle 7: Governments can sometimes improve market outcomes.

When markets do not work well, we speak of “market failure” (there will be much more on this later in the course). Sometimes a government can intervene in a market, by setting rules or restrictions that enable a better outcome for society than would be obtained through an unfettered free market. Many people believe, for example, that product safety laws or workplace safety rules are unambiguous improvements upon unregulated outcomes. However, the government cannot fix every problem, and sometimes government intervention in a market can end up making things worse for society. This is what is called “government failure,” and we will also look at this in much more depth later on in the course.

The last three principles, which I will simply list below, pertain to macroeconomic issues that will not be addressed in this course.

Principle 8: A country’s standard of living depends on its ability to produce goods and services.

Principle 9: Prices rise when the government prints too much money.

Principle 10: Society faces a short-run tradeoff between inflation and unemployment.

Utility and Individual Rationality

As outlined in the previous section, we are trying to study why people make the economic decisions that they make. To try to understand this question, we assume that people do things that make them happy. This is not a difficult concept to understand: any time we are faced with a choice, there is an outcome that will make us happier than another outcome. Some choices are not very enjoyable, such as doing our laundry or paying our taxes, but we do so because the alternative will leave us with less happiness: most of us prefer clean clothes to dirty, and most of us prefer to not be hounded into court by the taxman.

Economists don't use the word "happiness," but instead have coined another term: "utility." You might think of a utility as the company that provides your electricity or drinking water, and these have the same root meaning derived from the word "use." In the economic context, think of utility as the use, the value of the use or the happiness derived from the use of some good. Basically, "utility" is the economic catch-all term for whatever benefit we get from the consumption of some economic good, or in a broader sense, the benefit we derive from the outcome of an economic decision.

So, if somebody gets utility from making a decision, and more utility (happiness) is unambiguously better than less, then we make the claim that people are "rational utility maximizers." That is, in every decision that we make, we think rationally about the outcomes and make the choice that gives us the most utility. This is a simple and elegant statement, and it lies at the foundation of modern western economic thought, but it is not completely uncontroversial or even all that uncomplicated. For example, many decisions are not simple yes/no or A/B choices. Sometimes there are many possible choices - indeed, there are usually many possible choices, and we don't always know which of those choices will make us happier for the simple reason that we cannot see the future with perfect foresight. People make uninformed decisions, hurried decisions, unlucky decisions, and just plain wrong decisions every day. We are not perfectly rational, and we usually do not have either the time or knowledge, or foresight to always make the correct decision. This is an area of intense study at the boundaries of contemporary economic thought - several of the recent Nobel prizes in economics have gone to people researching what is called "behavioralism," a field of study that spans economics, psychology, and neurology. In other words, it gets really complicated. So, we make the assumption that people are rational utility maximizers. It may not be perfectly true, but it is reasonably defensible (most of us try to make the best decisions most of the time, and we don't deliberately do things that will hurt ourselves). Most importantly, it gives us a firm foundation to build upon. It is what we call a "simplifying assumption": we can assume it to be true, and doing so will allow us to answer a broad swath of questions about economic decision-making and outcomes. And after we have reasonably answered all of those questions, we can start relaxing our assumptions one at a time to see how the outcome changes. It turns out that, even if you relax the assumption of perfect rationality, most of the answers to the questions do not change in a meaningful or substantive manner.

Money and Utility

It is important to state at this point that money and utility are not the same things. People are not money-maximizers; for example, most of us would rather have the weekends off instead of working a second job. I could take a second job working in a restaurant at night, but I get more happiness spending my evenings at home or out with my family.

However, in this course, and in almost any other study of economics, you will find utility defined in terms of money. This action is defined as "monetization." This is not because we believe that money is everything. It is because we are lazy and want to explain things in simple terms. So, what we are using is using money as a common unit of measure and accounting. For example, for my winter vacation choice, I could go skiing or go to a beach resort in Mexico. In order to measure the happiness obtained from these two choices, we need a common unit of measure, and since money is a universally accepted proxy as a measure of value, that is what we use. So, economists talk about everything in terms of money because doing so makes our lives (and those of students) easier.

Positive and Normative Questions

Economists like to describe their discipline as a science. This seems odd to some people, who think of science as involving laboratories and experiments. However, any area of study that employs "the scientific method" as a mode of inquiry can be thought of as a science.

So, what is the scientific method? Well, there is no single broadly accepted definition, but there is a generally accepted framework. The scientific method is a structured method of attempting to answer questions about the world about us. In the case of economics, the "world" refers to the multitude of consumption and production decisions made by every person and firm every day.

The scientific method, as described here, has four basic steps:

- Observe

- Hypothesize

- Test

- Repeat step 1

We start by observing something in our environment that leads us to ask a question. Questions such as: Will a ball float in water? Will price controls lead to shortages? Will smoking cause you to die earlier? To attempt to come to an answer, we first need to ask the question in the form of a "testable hypothesis." Put another way, try to frame the question in such a way as to be able to test it and get a yes/no answer. Actually, we generally frame the questions so that the answer will be "no" or "not no." Note that "not no" is not the same thing as yes. "Not no" can be either yes, or maybe, or we don't know, or the answer is not clear. But we do want a question that can have a clear answer of "no."

This question is called a "hypothesis." We need to test the hypothesis with an experiment: some set of actions that will allow us to answer the hypothesis. In science-speak, we write the question as a "null hypothesis," so looking at our first question from above, I will state the null hypothesis as "this ball will float in water." We then perform some set of actions to test the hypothesis. In this case, there is a simple test: place the ball in water. If it sinks, we can answer "no" to the null hypothesis, or put another way, we can reject the null hypothesis. If the object does not sink, we do not answer yes, but instead we "fail to reject" the null hypothesis.

Notice that we are not trying to prove something to be true, but we are, in fact, trying to prove it to be false. This is the key aspect of the scientific method: we need to have a hypothesis that is testable and falsifiable. If something is not falsifiable, it cannot be tested scientifically. In science, nothing is proven, but many things are disproven. Some hypotheses, such as Newton's theory of gravity, have survived the test of falsifiability for centuries, and as such, we generally accept them to be "true," but, in reality, they are just yet to be disproven, after several hundreds of years of many smart people trying.

The above was a rather long-winded attempt by me to explain why economics is a science - a science that studies an aspect of a human society, which is why it is called a "social science." It is a science because economists, when they ask questions, strive to employ the concept of a testable, falsifiable null hypothesis. Unfortunately, it is much more difficult to do experiments. For example, we cannot impose a price control in one town and not in another, and observe the difference. What we can do is gather data from the world around us, and try to define "natural experiments" to help us test our hypothesis. So, for instance, we can look at different minimum wages in different states and try to ask questions about the effect of raising the minimum wage on youth unemployment. Unfortunately for us, we can not do " controlled experiments," that is, hold everything else constant and change only one variable. When dealing with society and natural experiments, there are many uncontrolled, indeed, uncontrollable variables, which can make hypothesis testing difficult and controversial.

So, what kinds of questions do economists ask? Well, for the most part, they try to ask "positive" questions. A positive question is one that can be falsifiable, or put more simply, has a yes/no answer. Think of a positive question as a "how is the world" question. A different kind of question does not ask how the world is, but how it "should be." These are referred to as "normative" questions.

For example, speaking again about minimum wage laws, a positive question would be "Do higher minimum wages cause higher rates of youth unemployment?", whereas a normative question might be "Are higher minimum wages better for young workers?" The first of those two questions should have a testable answer: yes or no. The answer to the second question hinges upon the definition of "better." We often hear the phrase "There oughtta be a law," or maybe, "We should have higher minimum wages." These are political questions, based upon values-based questions that are not falsifiable. I am not saying that asking these types of questions is wrong or incorrect; clearly, this is what the entire field of politics is about. However, these are not the kinds of questions that we like to ask in economics. Economists are people who see themselves as dispassionate scientists, attempting to rationally undercover the nature of the universe. At least, that's the goal most of us strive to, and in this course, it is the method of explanation I will attempt to employ.

Stated simply, I'm here to try to help you see how things are, and not how they should be.

A positive question is a "scientific" question that you can test it, you can look at the data, build and economic model, ... and eventually conclude if it is correct or not. However, a normative question/sentence is more like an opinion, that you can agree or disagree. You can't really scientifically test it.

The following video (3:59) explains the difference between positive and normative economics.

[Music]

Narrator: Hi everyone! Day four, Quick Econ. In this video we're going to look at the difference between positive and normative economics. When speaking about economic hypotheses, the way you phrase your statement is actually a pretty big deal. And in economics we can broadly define a statement as positive or normative economics. Now when you think of the phrase positive, you might think of something that's good, or something that's true, or something that you agree with. That's actually not the case. A positive economic statement is just a simple statement about what is, was, or will be. It's often written in an if-then form. If A happens, then B will follow.

Now this is important because it's written or spoken in a way that allows it to be tested with data. We can use economic data. We can look at the numbers to see if the statement is true or false. And what's important to know is that it's not always true. A positive statement could be a false statement. Normative statements, on the other hand, are values, opinions, or judgments. We ask do we think this is good or bad? And we can look for phrases like, I “think” we should do this, we “ought” to do that, or everyone “should” do this. It's a statement of opinion that cannot be tested to be true or false.

Now the easiest way to learn about positive versus normative is to just look at a couple of examples. So, examine the following statement. On average people tend to shop at Walmart more after they get a pay raise. Now you might look at that statement and say, well that's probably false. And maybe it is, but it's still a positive statement. We can look at people's income data, we can look at shopping data, and we can see is this statement true or false?

Now the following statement, everyone should shop at Walmart, that's a normative statement. We cannot test that with data. You look at that word, and you see should. That's an opinion. We can't prove that true or false. Now a big pitfall with positive and normative is that we often make the mistake of looking at a normative statement and agreeing with it and therefore say that it's a positive statement.

Look at the following example, rich people need to pay more taxes. Now many of you would say sure, that's true. I agree with that. That's positive economics. But there's some problems with that statement. Number one, the word rich is poorly defined, and also the way it's written we can't prove or disprove it. Rich people need to pay more taxes. Well, should they? Shouldn't they? Well we can't prove that. It's normative, even though you may agree. Now if you were to rewrite that statement to say if families with incomes over $250,000 per year paid higher taxes overall, tax revenues would increase. That is a positive statement. You can look at what happens to tax rates and tax revenues. You can see the relationship over time. It's a statement that you can test with data.

Now in reality, of course we generally prefer positive statements because we like to see if our hypotheses can be backed up with real life data and real life numbers. But normative statements do play a role in society, especially in legislation where we're examining policies with the goals of fairness in mind, and of course fair is a normative word.

Property Rights

When we start talking about market systems and trade, we will make an assumption that people have the legal right to trade something for something else, and to do as they wish with the goods they have traded for. That is, if you have money you can trade it for goods that you use in some way that you derive utility from, or if you have a good, you may sell it in exchange for either money or other goods. Of course, the good that most of us sell most frequently is our time and set of skills, sold to an employer in exchange for a salary.

This introduces the concept of "property," the stuff that you sell and/or use. A property right has two separate and specific parts. For something to be a person's property, it is necessary that both parts of the property right are present.

For somebody to hold a property right, they have to have both Use Rights and Disposal Rights. That is, for something to be considered a person's property, you have to have the right to use it as you please, and the right to exchange it for something else, or to dispose of it some other way, which can include destroying the good in question.

One confusing use of the term "property" is in the case of "public property," for which a specific individual may or may not have use rights, and definitely does not have disposal rights. There is a longer write-up on the topic of property rights on pages 32-36 of the text, which I recommend you read. Gwartney adds a third consideration, one concerning legal protection against unauthorized use, but I see this as simply an extension of the "use right" part of the definition.

Summary and Final Tasks

Before moving on to try to understand and analyze the workings of market systems, we need to have a broad understanding of just what we are trying to study in this class, and why. This was covered in this lesson.

At this point, you should be able to answer the following questions:

- What are the three axioms of the economic way of thinking?

- What are Mankiw's seven "principles of microeconomics"?

- Can you explain what economists mean by the terms "utility" and "monetization"?

- What is a normative question?

- What is a positive question?

- What are the constituent parts of a property right?

If you log in to Canvas, you will find the tasks to be completed for this lesson: a timed online quiz, an untimed homework assignment, and the weekly discussion forum.

Have you completed everything?

You have reached the end of Lesson 1! Double-check the list of requirements on the first page of this lesson to make sure you have completed all of the activities listed there.

Tell us about it!

If you have anything you'd like to comment on or add to the lesson materials, feel free to post your thoughts in the discussion forum in Canvas. For example, if there was a point that you had trouble understanding, ask about it.

Lesson 2 - Markets: Demand

Lesson 2 Overview

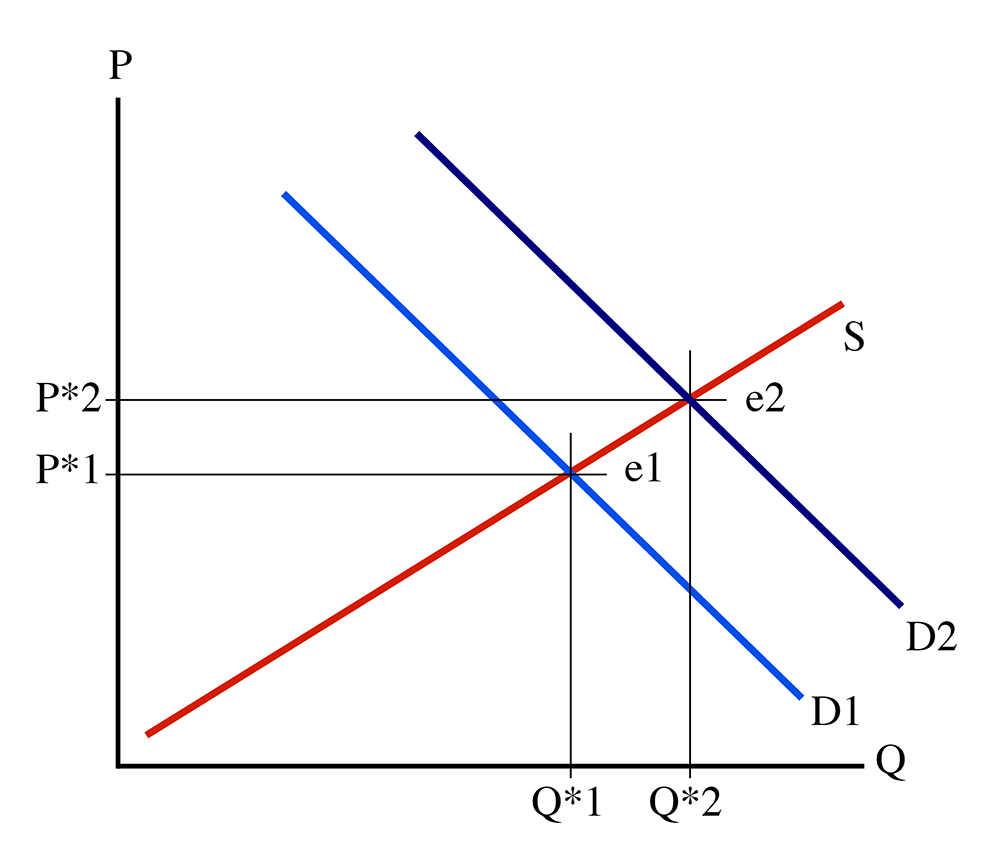

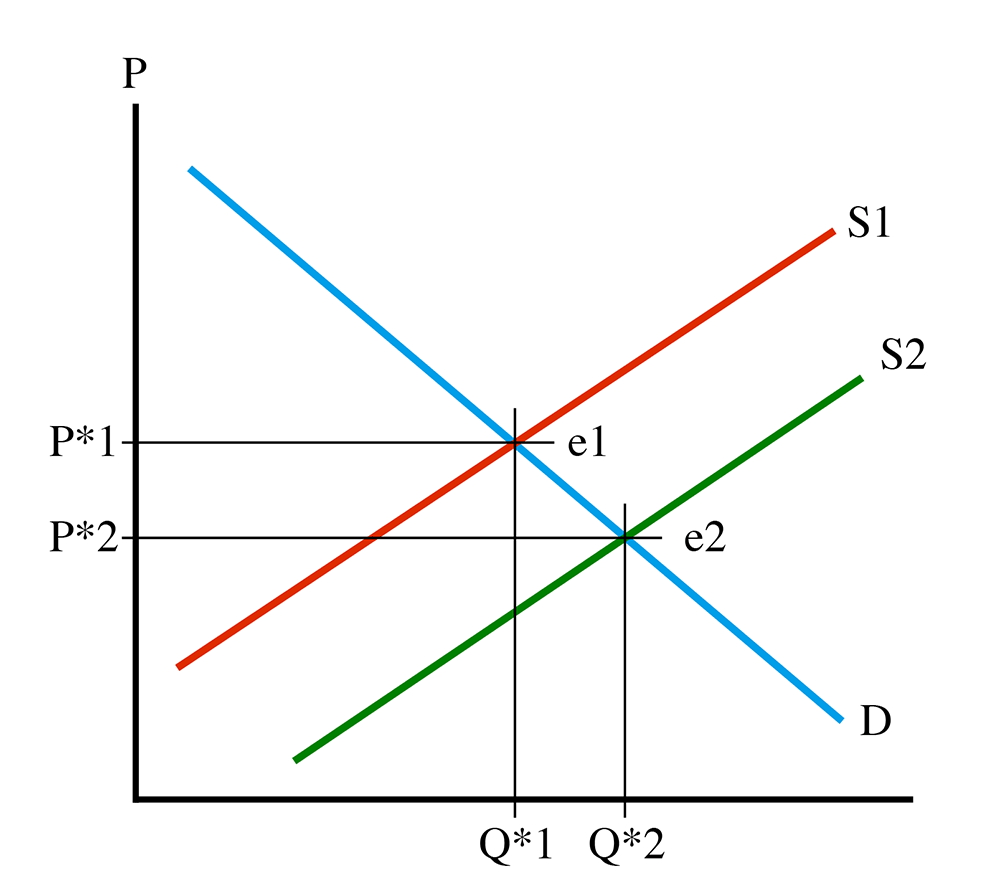

In Lesson 1, we spoke of markets and their role as both a process and arena for making production, consumption, and allocation decisions. In this lesson, we will introduce the fundamental tool for analyzing how markets work: the supply and demand diagram. After this introduction, we will take a deeper dive into one side of the market, the demand side. We will examine why people make the consumption choices they make, and how we can map these choices into a functional relationship between price and quantity consumed.

What will we learn?

By the end of this lesson, you should be able to:

- define and explain the concept of declining marginal utility;

- read a demand schedule and convert it into an individual demand curve;

- aggregate individual demand curves into a market demand curve;

- define and calculate price elasticities of demand.

What is due for Lesson 2?

This lesson will take us one week to complete. Please refer to Canvas for specific time frames and due dates. There are a number of required activities in this lesson. The chart below provides an overview of those activities that must be submitted for this lesson. For assignment details, refer to the lesson page noted.

| Requirements | Submitting Your Work |

|---|---|

| Reading: Chapters 3 and 7 in Gwartney et al. OR Chapters 3 and 5 in Greenlaw et al. | Not submitted |

| Lesson Homework and Quiz | Performed in Canvas |

Market Structures

Reading Assignment

Please read Chapter 3: "Supply, Demand and the Market Process" in the textbook. This chapter covers the material that will be covered in the next three course lessons, although it is in a bit of a different order to how we will cover it. I will focus on a few specific issues, and try to go into a little bit more depth than the text. So, I suggest that before you start this lesson, you should read through Chapter 3 and then refer back to the appropriate material as we work through the next three lessons.

In Lesson 1, we spoke of some of the axioms of economics and the fundamental questions that we are trying to address: who makes and sells what, and for how much?

Historically, there have been two basic schools of thought, which can be roughly categorized as "markets" (or "capitalism") and "central planning." In centrally planned economies, government agents are responsible for making decisions about production, distribution, and pricing of goods. In markets, these decisions are decentralized, placed in the hands of millions of individuals, who invest their time, money and ideas into the manufacture or sale of some product, with the hope of making a profit and enhancing their own lives.

Throughout much of the 20th century, there was tension between advocates of market economies and those of centrally planned ones, but over the past 30 years, there appears to have been a clear shift in thinking across the globe towards market systems. Centrally planned economies were largely shown to be less successful at meeting the needs and wants of their consumers, and less able to efficiently allocate money and resources in production. Even countries that are still nominally referred to as "communist," such as China, have adopted market-based reforms that have led to great increases in the welfare and quality of life of their citizens.

The Knowledge Problem

The great problem of attempting to centrally plan an economy is that of information. While it may be possible to understand technology, inputs, and production and distribution costs, and it may be possible to establish what the basic human needs of a society are (e.g., necessary quantities of housing, food, transportation, etc.), it is impossible to assess the entirety of human wants. We all want more than we need, and we all have a different idea of what it is that we want. Indeed, for each of us, what we want is a constantly changing thing, as our tastes, desires and abilities change over the course of our lives. The greatest benefit of a market-based economy is that it is the only place where all of this widespread information about diverse and dynamic human wants is exposed. This information guides producers to alter their production and investment choices to ensure that human needs and wants are addressed. In a market context, this is what Adam Smith referred to as "the invisible hand," the assembly of unseen consumer forces continually changing the production landscape.

Markets and Mixed Economies

When we speak of central planning versus market economies, it is very easy to assume these to be two discrete states of social organization. The reality, of course, is that we exist at some place "in the middle." For this reason, I am reluctant to use the term "free markets," as this implies that under a market system, people are free to do whatever they want. This is not true - there are many constraints on human behavior. Some of these are social and cultural, but a great many are regulatory in nature: governments telling people what they can and cannot do. In the context of an economic system, this is manifested by things like labor laws, product safety rules, hazardous materials rules, consumer protection from fraud at the retail level, and so on. We have a great deal of government involvement in our economic lives, even in the United States, which is frequently held up as the standard-bearer for free-market economics in today's world. Indeed, every year, several thousand pages of new regulations are added at the federal level, and countless thousands more at the state and local levels. Almost no aspect of our economic lives is free of some restriction or regulation.

An economy without any form of government intervention is referred to as "laissez-faire." This is a French term that translates to "let it happen," and the United States is certainly not a laissez-faire economy. The peak of laissez-faire probably occurred in the second half of the 19th century, and gave rise to industrial titans such as Andrew Carnegie and John Rockefeller, who became known as "robber-barons" because of the allegedly predatory way in which they ran their businesses. This gave rise to the first great wave of business regulation, and we have not stopped since. Thus, when speaking of market economies, it is best to refer to them as "competitive markets," and not as free markets, because they certainly are not free in the sense that market participants are not unrestricted agents.

A Model for a Market Economy

The market is a system where producers and consumers interact for the benefit of all involved. It is helpful to look at these two sides of the market separately at first.

On one side of the market is the Demand Side. People on this side of the market can be referred to as consumers, demanders, or buyers - these terms will all be used interchangeably for the rest of this course. Consumers can be thought of as "Utility Maximizers," where the definition of utility is that referred to in Lesson 1. When we speak of consumers, we are generally referring to the end-users of products or services, and not firms that make intermediate purchases of materials or labor.

The other side of the market is known as the Supply Side. On this side, market participants can be called suppliers, producers, or sellers. Once again, all three of these terms can and will be used interchangeably. Producers are typically thought of as profit-maximizers, not utility maximizers, and this is a crucial distinction and affects the way we analyze the behavior of these two sides of the market.

The title of this section uses the term model. A model is a way of representing something else, a kind of "stand-in." A model is necessarily simpler than the thing it is trying to represent and, because of this, there is some detail that is lost in the process. The trade-off that is made when using a model is that a model can make things easier to understand. When we speak of a market, we are talking about something that involves the individual, private decisions of billions of consumers and producers. There is no way in which we can represent all of these decisions and interactions, but we can come up with a tool that illuminates some of the big-picture, general concepts in a way that is easy to grasp and comprehend, and has stood the test of usefulness over time. This is what the supply and demand concept consists of - it is elegant in its simplicity, and extremely powerful at describing the behavior of markets in a generalized way at a high level.

If you choose to study economics in more depth after this course, you will find that the supply and demand diagram will still be the key tool that is used. But at higher levels, we look in more detail at either aberrations from the simplified behavior described in the supply and demand diagram, or we look in more detail at specific parts of the market. However, my point here is that the supply and demand concept is the main underlying model of a market economy, and a good and thorough understanding of it will allow you to make a solid analysis of any situation involving market interactions, even without deeper knowledge of the situation at hand.

The main goal of analyzing markets is to try to figure out:

- “How much of what stuff is made, and by what methods?”

- “At what price is it sold?”

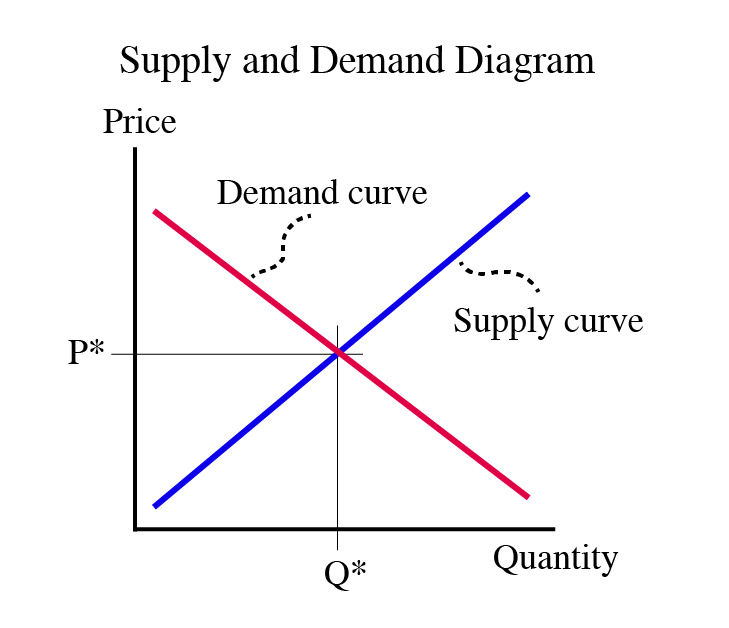

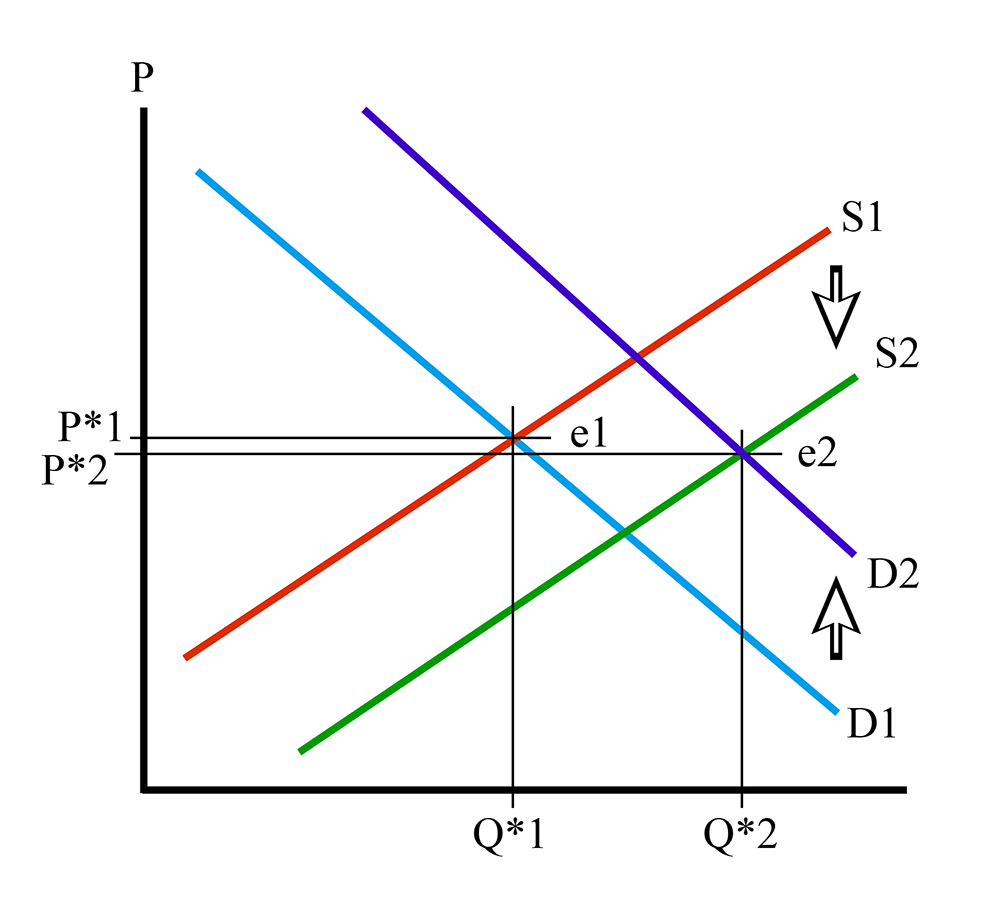

To figure these things out, we study supply and demand. The basic analytical tool is the supply and demand diagram, which is a MODEL of a market, as shown below:

Parts of the Supply and Demand Diagram:

- x-axis: measurement of quantity

- y-axis: measurement of price

- Demand curve: relationship between price and quantity people are willing to buy

- Supply curve: relationship between price and quantity that firms are willing to sell

- Intersection point of supply and demand curves: “market equilibrium”

Markets are dynamic—always changing—so a supply-demand diagram is always just a “snapshot” of a market at a moment in time. Another dimension is “time,” which we do not consider at this point.

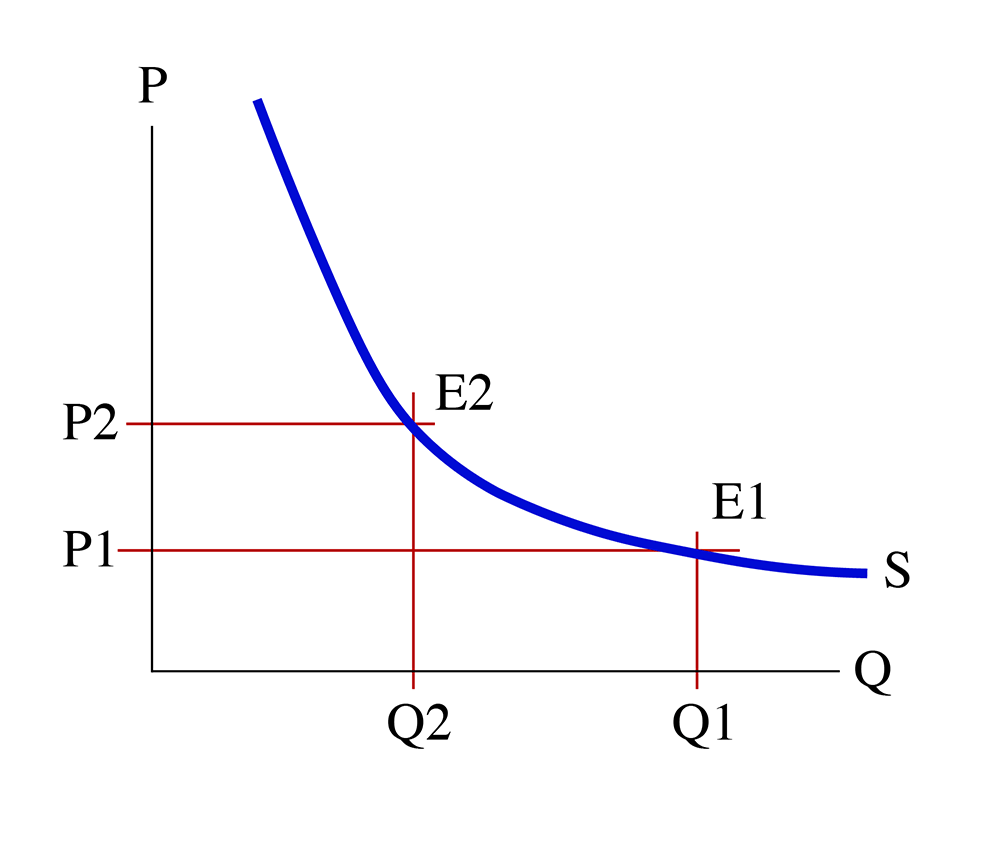

Figure 2.1 has two lines, which represent the two sides of the market, or the two parties in any economic transaction. The demand curve describes the behavior of the demanders in the economy. These people can also be called buyers or consumers. Restating: "demanders," "buyers," and "consumers" all mean essentially the same thing.

The other side of the market is described by the supply curve - the red upward-sloping line in the diagram above. The people *(or, typically, firms) on this side of the market can be called suppliers, or sellers, or producers. These three terms all mean basically the same thing.

Table 2.1 Demand Curve/Supply Curve Explanation| Demand curve describes behavior of: | Supply curve describes behavior of: |

|---|---|

| Demanders | Suppliers |

| Buyers | Sellers |

| Consumers | Producers |

Marginal Utility

In the first lesson, we spoke of the concept of marginal analysis. That is, we look at how something changes if we change some other thing a little bit. For example, what will be the effect on sales of raising price a little bit? Or what will be the effect on price of adding some new regulations to a market? We also spoke in Lesson One about the concept of "utility," which is the economist's catch-all term to describe happiness, wealth, value-from-use, and so on. Utility is basically the benefits that derive to a person from using or consuming a product or service, or, more generally, the amount of extra happiness a person gets from making a certain decision and executing that choice. One of the axioms we spoke of is that people are utility maximizers, and every choice that is made is made with the goal of increasing utility.

When we speak of demand in a market, we have to consider just how much utility does a person get from consuming a certain good, at the margin. So, we are considering a process of gradual change: how much utility does a person get from consuming one more unit of a good, and how does this change with further consumption? A great deal of research has been performed on this issue, and it generally backs up what we all know intuitively: the more we have consumed of something, the less value the next unit of consumption holds for us. This is defined as the concept of Declining Marginal Utility. This sounds like a complicated piece of jargon, but it helps to think of what each word means, and the concept becomes easy to grasp.

- "Declining" means "decreasing," or "getting smaller."

- "Marginal," as described above, refers to the effect of enacting some small change, i.e., "at the margin."

- "Utility" refers to the happiness we get from doing something.

String these three definitions together, and what we are saying is that the amount of happiness we get from consuming some good goes down as we consume more of it.

So, what does this mean in the context of a market? Well, to consume a good, we have to give up something to get it. Put simply, we have to buy it. So we give away some money, which can be thought of as a measure of potential utility, for a good that gives us actual utility. Since we want to maximize utility, we will willingly trade money for a good as long as we get more utility from consuming a good than we are giving away to get it. I will restate this, as it is perhaps the key underlying principle of a market economy: if someone gets $5 of happiness from consuming something, they will be happy to pay up to $5 for that good. If the price of the good is $6, then a rational utility maximizer will not buy the good: he is giving away $6 worth of utility to get $5 worth of utility. Nobody will do this willingly - if he has full knowledge of the values of the good and the money.

The concept of declining marginal utility is the foundation of demand-curve modeling, which is one side of our market model. This will be described in more depth in the next section.

Demand Curve

We will look at the supply and demand curves separately before we look at the way that they work together. We will start by looking at the demand curve. This is a Functional Relationship between the price of something and the amount of that thing that buyers (consumers, demanders) will buy at a given price. Looking at it another way, it is the maximum amount that a person is willing to pay for some amount of a good.

Where does the demand curve come from? It comes from individual preference and utility. An “individual demand curve” is how much a person will pay for a certain amount. This is calculated based upon the idea of “declining marginal utility,” which is another way of saying that the more we have of a certain thing, the less we value getting an additional unit of that good. For example, when you are hungry, you may place a lot of value on the first slice of pizza because you get a lot of utility (happiness) out of that first slice. The second slice gives you more happiness, but not as much as the first, and so on.

When you have had 3 slices, you place very little value on the 4th slice.

A person is willing to pay up to his marginal utility, but not more (because you will not give away more money than the amount of utility you get from using something).

Individual Demand Schedule

| Quantity of Pizza Consumed | Utility derived from consuming last slice |

|---|---|

| 1 | $5 |

| 2 | $4 |

| 3 | $3 |

| 4 | $2 |

| 5 | $1 |

| 6 | $0 |

Individual Demand Curve

Figure 2.2 tells us that after eating five slices of pizza, a person derives no marginal utility from consuming the sixth slice. It is entirely possible that the demand curve can go negative, although economists never really examine this. However, just think about it: let's say you have eaten six slices, and are very full. Eating another slice may cause you to get an upset stomach, or may make you throw up your food. Both of these are things that people do not want to happen under normal circumstances. In this case, the seventh slice of pizza is no longer a "good," but it is a "bad": consuming it will actually decrease the total amount of happiness of the individual. A rational person would certainly not eat a seventh slice.

Figure 2.2 is the demand curve for an individual. Usually, a market consists of more than one individual, so if we want to find out what the demand curve looks like for a market in its entirety, we simply add together all individual demand curves.

What do we mean by "add together"? Well, we can construct a demand schedule for everybody in the market added together. Looking at the demand schedule, we have it written in the form "How much utility do I get from each slice?" We can reverse this, however, and say "At a certain price, how many slices would I buy? If the price of a slice is $2.50, the person described by the demand schedule would buy three slices. They would not buy the fourth slice, because this slice only gives the $2 of utility, but they would pay $2.50 for it. That means that this person would be voluntarily making himself poorer by buying a fourth slice of pizza, and this would violate our assumption about rational utility maximization. As I have said before, in real life there are cases where people do not make the proper decision, but we have to assume that people usually intend to make a utility-maximizing decision. If we don't make that assumption, there are basically no rules for examining human behavior. We are left with chaos; I would not be able to teach this course. So, the assumption of rational utility maximization gives us a sense of peace and order that allows us to study economics. We can look at the messier stuff about bad market decisions later on.

So, getting back on topic, how do we create a market demand curve? Well, let's do a demand schedule, but instead of having the number of slices in the first column, instead, we have the price in the first column. In the second column, we have the total amount of slices sold at that price. By "total amount," we want to think about the total in the market area for one pizza store, or in one town, or on one university campus. It also makes this problem easier to analyze if we assume that the pizza from every shop in town or on campus is identical. Obviously, in the real world, this is not true, but we make this assumption, called "product homogeneity," because it makes life easier for us. Don't worry, we will relax it a little later in the course and see what happens. (Hint: more chaos! I prefer to avoid chaos.)

So, let's assume that I have collected a demand schedule from every person in town and that every person knew just how much utility they got from eating each extra slice of pizza. (Maybe they are all economics students and think about every aspect of their lives in terms of declining marginal utility and rational utility maximization.) (Hey, I do. It makes me a real hit at parties.)

So, now I put together a schedule of how much pizza will be sold at each price point. Let's say it looks like this:

| Price | Quantity of slices sold |

|---|---|

| $1 | 3000 |

| $2 | 2050 |

| $3 | 1350 |

| $4 | 750 |

| $5 | 350 |

| $6 | 125 |

| $7 | 5 |

If we were to plot this, like the individual demand curve, we get the following:

So, Figure 2.3 is what a "market demand curve" looks like. If you were the owner of the only pizza joint in town, this would let you know how many slices you will sell at each price. Of course, real life is a little more complicated for several reasons. Firstly, it is very unlikely that you have "perfect knowledge" of the demand curve. After all, how can you get everybody in town to tell you how much utility they get from each additional slice? And then, of course, we have another dimension: time. The demand for pizza on Friday night during the school year is a lot different than the demand on a Wednesday morning in the summer. And if you aren't the only guy in town, but one of several pizzerias, how much of that market will you capture? But, of course, we are making simplifications for the purpose of explaining simple principles here. As I keep promising, we can relax some of these assumptions and make things more complicated later. But, for now, let's keep things simple.

There is one thing you should note about the demand curves in both of the above graphs: they slope downwards as we go to the right. This means that as the price of a good decreases, more of it will be sold. Or you can say that as the price rises, fewer will be sold. Why? Because of declining marginal utility. After a person has consumed one unit of a good, they usually get a little bit less happiness from consuming the second unit of a good. Sometimes the difference in utility is very small, which means the curve will be very flat (more on this in the next section), sometimes it will be very steep, but in any case, it will be downward sloping. We cannot believe that somebody gets more marginal utility from consuming an additional unit. This is what we call the "First Law of Demand": demand curves are downward sloping. This means that if a seller raises the price, fewer of an item will sell.

Some Marginal Analysis

You are looking to buy pizza. Your “pizza happiness” in $ is described in the table below. Pizzas cost $2 each. How many should you buy?

| # of Pizzas | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Pizza Happiness ($) | 0 | 10 | 17 | 22 | 25 | 26 |

Method 1: Brute Force

Simply figure out your happiness for each number. Happiness=Pizza Happiness-Total Cost (remember pizzas cost $2 each). Inelegant, low score on exam, but it will work. Fill in the table below and choose the spot that maximizes your happiness (what we will soon call consumer surplus).

| # of Pizzas | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Pizza Happiness ($) | 0 | 10 | 17 | |||

| Total Cost ($) | 0 | 2 | 4 | |||

| Happiness ($) | 0 | 8 | 13 |

Method 2: The Elegant Economic Way of Thinking (This gets you all the credit!)

Let Marginal Happiness(X)=Pizza Happiness(X)-Pizza Happiness(X-1). Keep buying pizza as long as marginal happiness>cost of pizza (here $2).

Remember, decisions are made on the margin!

| # of Pizzas | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Pizza Happiness ($) | 0 | 10 | 17 | 22 | 25 | 26 |

| Marginal Happiness ($) | - | 10 | 7 | |||

| Total Cost ($) | 0 | 2 | 4 | |||

| Total Happiness (Consumer Surplus) | 0 | 8 | 13 |

Fill in the blanks, and pick your bliss point!

Practice Exercise

Delicious cuy (a delicacy in Peru) costs $10 a serving. Your cuy happiness is given in the table below. How many cuy will you buy, and what will be your total happiness?

| # of Cuy | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Cuy Happiness ($) | 20 | 36 | 47 | 52 | 54 |

Some people talk about something called a Giffen Good. This is a mythical good with an upward sloping demand curve, meaning that more sell if the price is higher. Sir Robert Giffen hypothesized that an inferior staple good, such as bread, might actually see an increase in demand as its price rises. The idea being that as the price of bread increases, poor consumers would have less money to spend on other goods (meat, for example), and would actually need to purchase more bread. You can probably see, however, that there would have to be a lot of constraints on this hypothetical world- no other types of inferior staple goods available as substitutes, and no corresponding wage inflation to provide additional income to buy bread, to name a few. In order to come up with a scenario where we have an actual, upward-sloping demand curve, we need to do a lot of semantical gymnastics and make a lot of special-case assumptions. Life is much simpler if we just believe that the First Law of demand holds. Which it does, of course, because it is the law, and not merely just a good idea. I like to think of it as the economic law of gravity. In a few special, rare and carefully constructed circumstances, you can appear to circumvent it, but for almost all of us almost every day, it holds true. (Or, I should say, is not falsified.)

Definitions

Demand Curve

relationship between price and quantity that people want to buy. Demand is not a number or a constant: it is a function, with different values at different places.

Marginal

This is an adjective (a descriptive word) that refers to the effect of doing a little bit more of something. So, the Marginal Utility from consuming pizza refers to the extra amount of utility you will get from eating one more slice of pizza. We often say “what will change at the margin,” which means “What will be the effect of a small change in one of the inputs?”

Main points about the demand curve:

- Demand curves always slope downwards (have a negative slope).

- This is called the “First Law of Demand.”

- They slope downwards because of Declining Marginal Utility: the amount of utility we get from consuming an extra unit of something is less than the amount we got from consuming the previous unit of that thing.

- Market demand curves are the sum of all individual demand curves.

Consumer Surplus

Assume you are hungry and you are willing to pay 5 dollars for one slice of pizza. However, you find that you can buy that slice for only 2 dollars. In that case, your total gain from buying that slice of pizza is 3 dollars because you were able to buy it for less than the value you put on it. This gain is called Consumer Surplus.

“Consumer Surplus is the difference between the maximum price consumers are willing to pay and the price they actually pay.”

-- Gwartney, et al., Microeconomics: Private and Public Choice, 14th Edition

Now consider the pizza market: individuals who are hungry and want to buy pizza, people who have different willingnesses to pay for one slice of pizza, some people who put more and some who put less value on that. Consequently, some have more and some have less gain (consumer surplus) by buying a slice of pizza. The summation of all these individual gains is called total consumer surplus in the entire market. In the following figure, the size of the triangular area shows the total consumer surplus gained by all the consumers in the market.

Assume P1 = $2 is the price of one slice of pizza. All the slices of pizza sold in the market (Q1) are purchased by the consumer who value the slice more than and equal to $2. Some consumers value it very highly ($span>8) and some value it less ($5). For each consumer, the gain is the difference between the value and the $2. Therefore, the area of the triangle between demand curve and price (P1) equals the summation of all gains. Clearly, if the value that a consumer puts on the slice pizza is $2 and he pays $2 for it, then the gain will be zero.

Note that we should distinguish between marginal value and total value of a good. At each point (at each quantity of good sold), the marginal value for the consumers is the height of the demand curve and the total value equals the summation of all those marginal values. Marginal gain equals the difference between marginal value and price. Therefore, total gain, which we call consumer surplus, equals the summation of all marginal gains.

In order to calculate the consumer surplus, we need to find the area between demand curve and market price, the area under the demand curve and above the price (horizontal line). As we can see in the graph, consumer surplus is affected by the price. The higher price makes the area smaller and causes lower consumer surplus. The lower price makes the area larger and causes higher consumer surplus.

So, in this example, consumer surplus can be calculated as:

Mathematical Representation of Demand Curve

We often want to perform calculations concerning total utility in a market, or total costs, or some such thing, and to do this, it is helpful to define the functional relationships on a supply and demand diagram with a mathematical equation.

So, an example of a demand curve may be specified as follows (Please note that P stands for "Price," and Q stands for "Quantity") :

This describes a downward sloping line, which intersects the y-axis (which represents price in a supply-demand diagram) at a value of 100, and declines in value by 2 for each extra unit we travel along the x-axis (which represents quantity of goods sold in a supply-demand diagram).

So, if the Quantity is 20, we would say , , and so on.

If you look at the market demand curve for pizza, on the previous page, we might want to describe it as P = 9 - 0.5Q, which describes a straight line with a y-intercept of 9 and a slope of -0.5. In that case, for example, market price for pizza when the quantity is 10 will be: .

Example:

Assume the market demand curve for pizza is . Calculate the consumer surplus if the price of pizza equals $3. Try to use two methods to calculate the consumers surplus:

- Mathematical equation

- Geometry: and calculating the area of the triangle

Then compare your answers. You should have the same answer.

Answer:

We need to calculate the area of the triangle. First, we need to find the coordinates of three corners of the triangle between demand curve and price. Then we have to find the length of the sides.

The coordinate of the three corners are:

Top corner: (0,9)

Bottom left: (0,3)

Bottom right: to find this point, we need to plug the price = 3 into the demand equation and find the Q. . And Q will be 12. So, the coordinate of the bottom right corner will be (12,3)

Knowing these three points, we should be able to calculate the area of the triangle as:

Geometry:

We need to draw the graph and calculate the area of the triangle ( ):

The market demand curve could be a more complicated function. This illustrates what I have mentioned before: real life is a very complicated thing to model, but in economics, we can use simple models to describe and explain human behavior and market outcomes. So assuming a linear demand curve may be a simplification of reality, but it aids our understanding of markets, and if we can perform numerical examples, it makes the illustration of concepts easier for a lot of us.

Practice Exercise

Calculate the the consumers surplus for P = 60 when demand function is P = 90 − 6Q.

P1 = 60

60 = 90 - 6Q then Q1 = (90 - 60)/6 = 5

CS = (90 - 60)*5/2 = 75

Price Elasticity of Demand

Reading Assignment

Please read Chapter 7 in the text (Consumer Choice and Elasticity) to accompany the material in this section.

Economics is a dynamic process. Given the millions of human interactions that make up an economy, it is not surprising that things do not stay the same for very long, if at all. Things change: this is the nature of a dynamic economy. We now ask, how much do they change?

At this point, this question relates to the shapes and slopes of the demand curves, which we will examine here. We will look at the supply curve in the next lesson.

In physics, the term “elasticity” refers to how much something stretches when force is applied to it. In economics, when we think about "elasticity," we are interested in how much a quantity demanded or supplied will change when some “force” is applied to the market. Both the demand and supply curves have elasticities. Let us talk first about the elasticity of demand. The phrase “elasticity of demand” is incomplete: we are talking about the response of demand to something. So, for the title to be complete, we have to talk about the price elasticity of demand. That is, how much does the quantity demanded change when price is changed? We could also talk about the income elasticity of demand, which asks “how much does the quantity demanded change with income?”

The price elasticity of demand is defined as the percentage change in quantity divided by the percentage change in price. Or, mathematically, we get:

The Greek letter eta, , is used to denote elasticity.