Lesson 12 - Economic Challenges in Integration of Renewable Resources

Lesson 12 Overview

Overview

For many decades, the companies that operated electricity grids had to do so with two objectives in mind: reliability (keeping the lights on) and cost (keeping electricity affordable). Despite the complexities of the electric grid, these two objectives were relatively simple to meet, in part because the regulatory system shifted a lot of the financial risk away from companies and onto ratepayers. It isn’t that hard to keep a power grid reliable by overbuilding it.

This lesson builds on the previous two objectives by adding a third to power grid operations – lowering the environmental footprint of power generation by adding large amounts of low-emissions generation resources. This is, very broadly, sometimes called the “renewable integration” challenge. The technical challenges in maintaining the balance of supply and demand are immense, but our focus is on the economic challenges, particularly in the context of electricity deregulation.

Learning Outcomes

By the end of this lesson, you should be able to:

- Define the term “Variable Energy Resource” (VER)

- Explain three reasons why large-scale power generation from VERs poses an economic challenge to the electricity industry, not just a technical challenge

- Identify the various types of ancillary services that electric system operators require to maintain reliability, and identify those that are likely to be particularly important for VER integration

- Explain capacity payments and the rationale for having separate payments for electric capacity and electric energy

- Explain how demand-side resources could participate in deregulated electricity markets

Reading Materials

There are a lot of good resources that describe the renewables integration challenge. We will lean on external readings more heavily in this lesson than in previous lessons.

- Carnegie Mellon University Scott Institute for Energy Innovation (2013). Managing Variable Energy Resources to Increased Renewable Electricity's Contribution to the Grid [1].

- Cardwell, D. (Aug. 15, 2013). Grappling with the Grid: Intermittent Nature of Green Power is Challenge for Utilities [2]. New York Times.

- Reed, S. (Dec. 25, 2025). Power Prices Go Negative in Germany, a Positive for Energy Users [3]. New York Times.

- Hittinger, E. (2012). Chapter 4: The Effect of Variability-Mitigating Market Rules on the Operation and Deployment of Wind Farms [4]. In Energy Storage on the Grid and the Short-term Variability of Wind. [Doctoral Dissertation, Carnegie Mellon University.] The important part of this chapter is the discussion of different renewables integration policies around the world. Note that the link goes to the entire document but that you are required to read only Chapter 4.

- National Energy Technology Laboratory (2013). Ancillary Services Primer [5]. This short paper describes different types of ancillary services and how generation companies can compete to provide these ancillary services. For related, optional reading, download this Power Market Primers ZIP file [6].

- Rocky Mountain Institute (n.d.). The Economics of Grid Defection [7]. The report as a whole is worth a read, but the four-page summary captures the main points.

- Please watch the following video interview. If the video is slow to load on this page, you can always access it and all videos via the Media Gallery in Canvas.

Video: Interview with Liz Cook (43:29)

MARK K: So Elizabeth, we've known each other for about six months. Tell us a little bit about yourself.

ELIZABETH COOK: Yeah. So I am born and raised in Pittsburgh, Pennsylvania. I'm currently working for the electric utility that serves Pittsburgh, but also just two counties, Allegheny and Beaver County. I went to school at the University of Pittsburgh, and I guess I got my bachelor's there. Continued on with my education. Got my Kansas State master's degree while employed. And then I currently wrapped up my doctorate just this last October in electrical engineering from the University of Pittsburgh. So I'm a Pittsburgh diehard fan, and that's kind of the perspective that I can share today.

MARK K: Excellent. Excellent. And apologies for the banner behind-- behind there. I'm a Penn Stater. You've talked about your educational background. Why did you study electrical engineering?

ELIZABETH COOK: Ironically, I've had to share this story a couple times this year already.

MARK K: [LAUGHS]

ELIZABETH COOK: My father-- I was always good at math and physics, and my father towards the end of my high school career said that he would support our-- our, me and my two older brothers-- if we were either a doctor, a lawyer, or an engineer. So he got three engineers and one turned lawyer out of that speech. So he just really told me that-- and he's actually an accountant by trade, CFO. And I was raised-- my mother was a nurse. So it's not like engineering's in our family. But he just sure that having these types of degrees would have-- it would open doors for us. And I definitely have to agree with him now, looking back. Many doors have been opened with my electrical engineering degree.

MARK K: Great. So you're now working at Duquesne Light, who's the-- who's the local utility-- the local electrical utility in the city of Pittsburgh. What specifically are you working on there?

ELIZABETH COOK: So when I came to Duquesne Light-- I've been here for five years. Prior to that, I was actually a power system analysis consultant where I worked for Mitsubishi Electric. And I specifically was in the transmission world, really running studies and understanding how the system works and all the equipment associated with it. And I was traveling quite a bit. And my family more or less started saying things like, where are you, Mom? So I-- actually, it's six miles from my house. And I was the system planning manager. So I'm transmission and distribution. At first, just transmission, and then I took over the distribution role. And I started seeing a lot of parallels in regards to how the distribution grid was starting to become very different than the last 100 years. So the last couple years, I've been really arming Duquesne Light leadership and really awareness that we as a business and a utility model need to focus on the edge of the grid. So just this past December, I was promoted to general manager of Advanced Grid Solutions. And the idea behind this new team is really for us to not-- not lose focus of the core business, which is operational efficiency and creating the safe, reliable, and secure grid that we have, but really, what can we do from a technology, people, and processes perspective to ensure that we're prepared and set to pivot at any point in regards to all the different new energy-type technologies that are kind of playing in our field now? So I'm overseeing that role and really just kind of educating the company and external stakeholders of how we can evolve and transform the current electrical grid for the future that has yet to be defined. So--

MARK K: Great. Great. So what do you think will be the most important takeaways for a student trying to understand the electrical system of the day?

ELIZABETH COOK: I could talk about this a lot, a long time. So one thing I think is really powerful is really digging into and thinking about, where did the grid come from, and why is the grid what it is today? And so there's great history in how the largest machine in the world has been created. And it really came from the backbone of engineering, science, and physics, evolving this idea of, OK, there's this flow of electrons. How do we maintain control and use it to our advantage, which is to power our lives? So the grid is only 140 years old in retrospect. And when you think about how it started and where it is today, we're actually using a lot of the basic fundamental principles from and founded in the 1600s and 1800s. And once we decided on how to set up the system and run those electrons across America and really the world, a lot of the innovation and the spirit behind new ideas or thinking outside the box was really hard to penetrate into this very massive machine. But understanding how those different technologies that exist today were able to become imprinted on the grid will really help us kind of, like, peel back the onion. Understand, how can we now really start thinking and re-innovating how we use our grid? Based on the fact that semiconductor theory and the inverters and all of the newer technology that wasn't available or known 100 years ago can now be used. So how can we work those two worlds together, the old and the new? So I think that's-- you know, really dig in and just kind of understand the history. And then start thinking of, well, why? And you'll find it really comes down to legislation and policy. [LAUGHS] But also the technology part of being efficient and affordable.

MARK K: Right. Right. And a really interesting place to do it is in Pittsburgh, because so much of the business really evolved there at the end of the day, right? I mean, the founder of the company you work for was a pretty famous guy. [LAUGHS]

ELIZABETH COOK: Right. Westinghouse. And--

MARK K: Mr. Westinghouse. Yeah.

ELIZABETH COOK: George Westinghouse's brother-- I believe it was Herman-- was the president of Duquesne Light. So that's kind of an interesting history.

MARK K: Very-- very cool stuff. So what's the-- the biggest thing that you think has changed in the wholesale-- wholesale power market since you've been in the industry?

ELIZABETH COOK: So definitely my career started-- I was not learning about markets. And it was really about, how does the electrons get from-- from A to B? However, with the introduction of the renewables and really the idea that they are intermittent, so they're not baseload and not available when called upon, it had to-- the markets had to change to that ideology, right? And they started creating non-standard products to sell in the markets, right? And it started in California. The whole-- I don't know if you guys know about the duck curve, but--

MARK K: Oh, absolutely. You know, the duck curve is probably the-- it's the introduction of the whole course here, so yeah, please go on.

ELIZABETH COOK: So you know, that belly and how to handle the belly part as well as the speed, like, that you had to create new products. And those were very unique, but now they're becoming more proliferated across all of the grid and really changing how the markets are structured. So I guess the idea that the markets had to create something non-standard, and now the non-standard's becoming standard, so what's next? And just the load-- how we're shifting our load. Like, we're very predictable creatures. So we all got-- get up. We used to all go to work, come home, and go back to bed. So that load-- that load and matching the generation was very common. But now is there are different ways that we can dispatch that generation to serve our varying load purposes.

MARK K: Right. So I guess rather than talk about the wholesale and the resale market, maybe we can talk about it in terms of transmission and distribution. So what do you think on the distribution side has changed since you've here since you've been doing this?

ELIZABETH COOK: There really was no market on the distribution side, so now there's been a lot of talk lately of, what is this-- what could this market be? What really-- could we reinvent it? Or do we merge the distribution with the transmission market, or does it have its own? But in regards to, like-- you mean the retail market?

MARK K: Sure.

ELIZABETH COOK: From-- from PA, we're deregulated. So the retail market, we actually have a lot of protections as customers. So we don't have that scenario such as what just happened in Texas, right? Where we may possibly get a bill for thousands of dollars based on the retail market going crazy. So it's a little bit calm. But one thing that we do have in PA is the net metering option for customers where they can be prosumers. So just instead of consuming the electrons, they're also pushing onto the grid, and they get paid-- you know, I think in our territory, like, $0.07 per kilowatt hour. So I mean, there's a market there. I think because solar-- I might be jumping the ship, but--

MARK K: No, go ahead.

ELIZABETH COOK: --is cheaper and affordable to the masses because of the whole economics of how it is just getting cheaper, because more people are using it, that $0.07 is becoming actually a very possible profitable number to then install the solar. So just in the last three, four years, watching our interconnection queue filling up. You know, some say it's not here, but I truly-- f you read the tea leaves and observe what has been happening in other states, it is here, and it's only going to proliferate based on the economics. So that retail market. And then really, also what's happening at the same time is we have that FERC Order 2222.

MARK K: Right.

ELIZABETH COOK: So there's going to be a pivot point for our customers as well as the third party aggregators or those entities that want to play in the solar market is choosing, do I stay on the retail versus-- or do I want to play in the wholesale with my generation? And that's just creating a dynamic of just looking at both markets and trying to understand, you know, what's the best plan?

MARK K: Right.

ELIZABETH COOK: So I know you have more questions.

MARK K: Oh, sure. Absolutely. But I mean, that's great. So what trends do you see in the market itself and in what you're doing from the interconnections perspective that are encouraging to build out of, say, 1 utility scale solar?

ELIZABETH COOK: So we probably don't see it right now, like, at Duquesne Light or in PA, but there are definitely case studies that are showing that the utility scale PV is up-- it can be seen as a positive, right? Non-wire solutions are becoming options where the distributed resources at the edge of the grid can help and support the reliability and resiliency of the entire network. So that seemed like maybe a pie in the sky. Not a lot of believers maybe five-- even five years ago. But they're definitely have-- projects been done, cases have been proven that if they are placed in the right areas of the grid and planned accordingly that they can be an asset and not just a detriment to the grid's operation.

MARK K: Right.

ELIZABETH COOK: I think that's promoting utilities to look there, because it could be cheaper to install this instead of building a large line or increasing capacities in transformers, et cetera.

MARK K: Right. Right. Due you think-- and I'm getting a little bit off the script here. Do you think that the proliferation of the solar plus storage solution makes it even more attractive for utilities to want to-- to want to interconnect with these types of assets?

ELIZABETH COOK: I mean, you know, from our-- just, like, Duquesne Light's perspective, we're a lines-only company, so we can't really have a play in the generation space. But yes, [INAUDIBLE]. The solar battery combo is really the Achilles heel of tipping the whole grid of how we actually start to think about how we receive our energies. So that has definitely become a great incentive to really look at those projects. Even like a company as large as NextEra, you know, they first were the kings of wind, you know? They've [INAUDIBLE] a significant amount of wind on our transmission grid. Then they went to solar. And now more recently, they're becoming very quick to batteries. So it's like a trifecta. You've got your wind, solar, and your batteries. I mean, just a few of those built on the large scale will transform how we think about, again, our baseload generation and really kind of turning a turning point.

MARK K: Right.

ELIZABETH COOK: And then also from, like, a DLC, like, our C&I customers, right? That's Commercial and Industrial customers. They're pushing their incentives to be-- you know, have renewable resources and that desire in their portfolio. So that's really driving DLC's perspective of understanding how those technologies work, and it's showing up for the deregulated side that we have to understand it and connect with it and ensure that our grid can handle that. So we're seeing that right now.

MARK K: Great. So what are-- and this gets really to, I guess, kind of what you do. You know, what do you see as the biggest interconnection challenges for-- for solar or solar plus battery, and even other Distributed Energy Resources or DERs?

ELIZABETH COOK: So depending on the size of the connection, you know, anything over five megawatts triggers an interconnection study by the utility. So like, I oversee the interconnection study process where, one, if you think about how the grid evolved, again, is you've got-- you had your generation serve the transmission which stepped down to the distribution. And it wasn't until really the 1970s, maybe a little-- slightly earlier, we started tying the transmission grid in with other transmission grids, which really drove the necessity for models. So really, since the '80s and '90s, we've been able to run real-time power flow simulations on the models. 16:48 But those electrons went one way. So from the distribution grid's perspective, it was really Ohm's law. And you can kind of calculate, OK, well, here's a feeder. Here's the impedance. Here's the load. And to plan the distribution system really didn't require those large, verbose models to run these power flow systems. What's happening is with DER and the introduction of, hey, I want to connect your distribution grid, it's requiring the utility space and those who do not have models to very quickly get models.

MARK K: Right.

ELIZABETH COOK: So that's a hindrance, I think, that just from a utilities perspective is like, we've got to create these models a lot faster than we thought we needed. And therefore, AKA, like, that could be a challenge, that you're trying to connect with a utility that can't study it. But let's just say they do have models and they can run the studies. You know that. There's a long delay period. And then it comes down to-- and when the proliferation is low, the likelihood of triggering some large investment in the grid is very small. But one thing we're starting to see-- and really, I know Central PA utility is seeing it too is you're starting to see penetration on the distribution feeders that are actually triggering some pretty expensive investments. So then it's the same question the transmission grid had to deal with 20 years ago. Who pays for that? Right? So if you want to connect your five-megawatt solar farm and it creates an overload and now it's $5 million to make this circuit viable, who pays for that? So that'll complicate it. But then getting into more challenging is the facilities part. Like, what is the metering? What is the sensing? You know, what is your communication? And then what is the utility saying needs to happen during a system fault? So really just getting to the nitty gritty of how that inverter will operate with the integration of the grid. And you'll find a lot of utilities are taking different positions. Some utilities are OK with some wireless communication. Others are driving fiber all the way up. Who pays for the fiber? So I think just a big challenge for solar developers is every utility that they engage with is going to be a different processor of flow, different technical [INAUDIBLE],, and different standards. So you just kind of have to be on your toes and really be-- have the technology part on your side as a developer to be able to work with the utility space, because everyone's very different. So I mean, those are lots of challenges there, but that's kind of the nitty gritty.

MARK K: Sure. So shifting gears a little bit, I'd love to hear your perspective on the recent reliability events that we've had, both sort of the cold weather winter storm Uri and also what kind of happened in California with the blackouts that they had to run out there because of the fires.

ELIZABETH COOK: So Texas, you know, was-- I mean, I think it's pretty basic. They didn't plan for the cold weather as an entity. So-- as an entity meaning the state of Texas.

MARK K: Right.

ELIZABETH COOK: So if you think about transmission planning, distribution planning studies, we do it based on peak loading and light loading. And then you break it down by, like, summer peaks, winter peak. So fundamentally, they did not study what would happen if there was a cold snap across all of Texas. Therefore, that triggered a lot of things that they probably overlooked, and that came down to the winterizing of their equipment. And when I say their equipment, the generation side. So it wasn't-- the wind wasn't blowing, right? Because they were frozen or the solar panel shocks. I mean, Texas has barely no solar panels. But the gas lines froze. Some coal piles froze, right? So really, it just came down to not having your generation there when it was called upon. So the operators created controlled blackouts, which I think a lot of people missed that in the media. It wasn't that they lost control of the grid. It was that they made decisions quickly to drop loads in parts of the grid, and so that they could bring it back on. So from-- you know, one thing, if you think about it, if you look at the polar vortexes, I think we had one in 2011, '14 '18, and now 2021 that not only-- it didn't impact Texas. It impacted, like, SBP, MISO, and PJM. I believe we were a 500-megawatt generator away from a blackout at PJM in 2011.

MARK K: Right.

ELIZABETH COOK: So I think there's just going to be a lot of lessons learned. And if you think about, what would be required of this generator fleets to winterize, it could be quite pricey, because a lot of the stuff is done during construction. So you know, who pays for that? Like, what's the incentive? Maybe it's a very high risk but low probability that we're ever going to have a cold snap. And then there's a lot of talk about them being not federally regulated. We actually do not have any standards on our federal-- so from NERC-- that demand or require generation fleets to winterize. But as an industry, you do best practice. So ironically, we're in drafting stages of creating winterized standards. So it wasn't just Texas that didn't winterize. It's just a best practice, and they got stuck in very cold weather. So it was just a very sad event. But I think there are a lot of positives that didn't get a lot of attention. But they were and able' to stop and prevent a month-long-- months-long blackout based on understanding how the grid was operating and how to save those generators from going offline indefinitely by having the technology. So that's Texas. And then California, well, there's the wildfires and then also the heat snap when-- if you think about California's grid is they import a lot during their peak season for that base load generation. You know, Palo Verde the nukes near Arizona, and then there's, like, [? Knob ?] up there in Nevada. And then you have all your hydro coming down from Oregon and stuff. And so I believe during some of the scheduled blackouts-- which, aren't they called brownouts? But I don't know.

MARK K: Yes.

that actually had the generation were using it. So I think then it comes down to that built-in reliability and resiliency of having that reserves available. And right or wrong, you know, California has reduced a large amount of their baseload fossil fuels or even nukes, right? And they just have a whole new solution to figure out. But that's why it was happening and the generation wasn't there. And then with the wildfires, they were-- PG&E ultimately got sued for the fires. So therefore, they took the hard line and said, OK, if we're going to be at fault for these fires, then we're going to turn people off when the fires are near our lines or any potential thereof. So again, it was a controlled approach that no one fundamentally understands and probably wasn't-- no one really liked their lights being turned off. So one thing I think's going to come out of California is this idea of expediting microgrids, right? The smaller-- creating microgrids for pockets of their communities that it's actually-- when they have one singular line being fed out into the middle of nowhere to, like, several hundred homes, it could be in their best interest to create a microgrid out there instead of running that line through the woods. So it'll be interesting to see what different products and ideas that they come up with.

MARK K: Definitely-- definitely disruptive.

ELIZABETH COOK: Yeah.

MARK K: So given these-- these crises or reliability events, do you think that this-- that they'll slow down the uptake of renewables or not?

ELIZABETH COOK: I think the path that the-- you know, the economics that are occurring right now, it would be very hard to slow down renewables or clean energy technologies. I think right behind wind, solar, batteries is going to be green hydrogen, and that's coming hot in regards to being accessible and available. And I don't think it will-- I mean-- I mean, this is my humble opinion. I feel like gas will be probably a big gap fuel for a while. I think coal in general just-- there hasn't been enough recent investment in these large power plants. It's just going to be-- the economics aren't there to save them, and they need to reinvent themselves in-- you know, they're just old and it's expensive for the fuel.

MARK K: Right.

ELIZABETH COOK: So I don't think this is going to slow it down, but I think more people are tuned into this new technology that creates new markets that drives more jobs. That really gives us something new to work with. Therefore, it's like another avenue to proliferate this technology. Is it the answer? You know, it might not be the-- batteries and solar may not be the perfect answer, but I think it's going to keep moving.

MARK K: Right. Right. So it certainly-- it certainly helps to smooth out some of that intermittency and actually could provide some of the ancillary services that you get from a gas plant or a-- or a coal-fired power plant. So what do you think are the biggest challenges we face in these markets going forward or on the grid going forward in general?

ELIZABETH COOK: Oh, where to start? So I think--

MARK K: That's-- keep going. That's why we're here, right? We want to talk about this.

ELIZABETH COOK: So one of the big ones that, you know, I don't think a whole lot of people talk about is, like, the utilities ability to see the edge of the grid. So there hasn't been a need to understand what's happening in each of our homes. And not that utility wants to know what's going on inside the home. They just want to know, are you going to be injecting electrons, or are you going to be absorbing them? And is your load curve changing? Because, oh, by the way, customers, we've believed you to be very predictable for the last 100 years. So that's how we have all of our equipment designed and standardized to. So if this is going to change, well, we need to understand it so that we can then serve and continue to serve. So I think the customers and regulatory and third parties just understanding the idea that utility space needs to get up to speed in regards to having that ability to understand what's happening on the grid that they currently are regulatorily required to be safe, reliable, and affordable. So there's a lot of dynamics there on how much technology can be invested and when and how quickly.

MARK K: Right.

ELIZABETH COOK: And so when I talk about technologies, I guess what I'm thinking about is applying the sensors and the equipment at the edge, having the ability to bring back now massive amounts of data that we've never had to handle or even know what to do with, create that technical [INAUDIBLE] within the utility space. And then once it's available that you're cleaning it, you're organizing it, and you're providing it so that insights can be made. So there's tons of opportunity for computer science, machine learning, big data analytics that need-- the utilities need to kind of latch on to and start to develop. So that has to be happening while the core of the utility business is still occurring. The poles are staying in the ground. The wires are healthy and strong. The transformers are being refreshed and not running to failure.

MARK K: Right.

ELIZABETH COOK: So you're transforming kind of the core of how you do all of that, while also at the same time setting yourselves up to prepare for this deluge of new technology that we've never had to deal with.

MARK K: Right.

ELIZABETH COOK: So I guess when I said, you know, what are the difficulties, it's really just keeping your pulse on all of these different technologies and third-party entities that want to take part. You know, and support, help build the bridge. You can call it whatever. It's still-- it's just different. So there's lots of challenges. But just-- I think everyone, we need to do it together. That's another thing. Like, collaboratively and with a mission of one goal, that we keep the lights on for all, and not this idea that we have all these new technologies that can take big chunks of C&I customers off of the core grid, leaving the low income, middle class entities stuck with the grid that now becomes even more expensive because everyone's off doing their own thing with their new technology.

MARK K: Right.

ELIZABETH COOK: So how does that happen together I think is going to be a huge challenge.

MARK K: Right. Right. Cost shifting could be a-- it's-- it's--

ELIZABETH COOK: Right. They'll be stuck with an old grid and higher bills.

MARK K: Right. Well, I-- I can-- I can tell you stories about the-- the other-- the other utility that was there in Pittsburgh that was owned by Westinghouse Equitable Gas. And we used to always get very, very worried that there was going to be one customer and one MCF over which we had to flow all our fixed costs, because everyone was going to-- everyone was going to leave. So it's a similar it's a similar situation that you guys are looking at there as well. So yeah, I can't-- it's difficult for me to comprehend when I go on to-- go on to the PJM website and look at all the nodes that they have to price and see the number of records, and see it out, you know, 8760 data, which then becomes 8760 times 50,000 nodes, right? That's fine. But then look at Duquesne Light, and how many customers do you have? And you have to-- you have to-- do you have to have that kind of information there? And it's a couple of orders of magnitude probably even more with the way that the-- the potential intermittency that could happen with solar coming on and on and off at all these nodes. And then somebody decides they want to charge their electric vehicle or discharge their electric vehicle, because they have some sort of service-- service opportunity to provide power back to the grid during a demand response event, right? And you need it there, and how does all that-- how does all that fit together?

ELIZABETH COOK: Yeah. So like, just kind of summarizing all the different disruptions is you have your distributed energy resources. So you have the solar, the battery, and everything that's happening at the edge. And you mentioned it. Transportation electrification, right? So now you have all of these EV charging stations popping up on your grid. How do you ensure that we are going to be present and available to serve all of those new charging points?

MARK K: Right.

ELIZABETH COOK: And then this idea that us customers, we will want to become more active and understand and have access to how we use our energy from a day-to-day. So what kind of digital gadgetry can we all have at our fingertips where we get to change our thermostats, which we're all doing right now, right? If someone gets a pulse point, like, hey, if you change your thermostat, you'll get an extra couple cents on your bill.

MARK K: Right.

ELIZABETH COOK: And then just energy efficiency, right? So while we're having this uptick in electric vehicle charging stations, we have this huge energy efficiency drive with buildings becoming more efficient and everything else for the sustainable kind of green initiatives. And now we have to balance that with our increasing load. So that's just very dynamic.

MARK K: Right. Right. Absolutely. So just to talk a little bit about Order 220-- Order 2222. Do you have any notion about how that might fit together? And does that keep you up at night? Or you know, what makes you think about-- what do you think about that particular piece of legislation? Or regulation, sorry.

ELIZABETH COOK: Yeah. So I think it is-- you know, from the personal just, like, challenging perspective, it's pretty exciting. From the business model and are we prepared and ready, it's daunting. So FERC Order 2222, not only are they reducing the boundaries or, you know, attempting to for injectable DER-- so like the solar battery at the edge-- but they're now quantifying DER as energy efficiency programs, demand responsive programs. So kind of all those disruptions I just spoke about, it really gives-- this order is challenging PJM, which-- who is our overseer of the transmission market. They only see down the transmission node. The power to open up markets to this new distribution asset idea. So there's just a lot of push and pull of, like, who has the data? Why do they need the data? Who has the control? Why do they need the control? And so I think from my perspective, it's still a lot of education to-- you know, like, if you think about the transmission and distribution world, up until, like, 15 years ago, the transmission folk didn't even know about the distribution and vice versa in utility space. And the lines became slightly blurred. But unless you worked in both, power grids operate and what you're concerned about and why and when and where is so different.

MARK K: Right.

ELIZABETH COOK: So what I find very interesting is the conversations that the TOs, the transmission people, make very broad, sweeping statements that do not relate to how the distribution grid actually works. So that part is really daunting-- like, education piece in general, right? Like, you have an entity that's being required by the federal government to create rules and policies and procedures to enable something that they're not very familiar with how it should even-- nobody is, really. It's not just them, of how that's going to react. So the owners of these assets are still going to be required to deliver a safe, reliable, and affordable grid. They have, like, thousands of new entities that want to play with it too.

MARK K: Right.

ELIZABETH COOK: So like, everyone-- I think FERC was requiring all the RTO ISOs to file by this July, but majority of us have filed for an extension. So we do have another six months to kind of work together to come up with something that we can work with. And I think everyone understands it's going to be-- it's the journey. Like, there's not going to be a destination. But we need to be careful of, are we going to trigger anything that-- and this is actually-- the federal jurisdiction is kind of creeping into the state jurisdiction. So if you think of PJM, they see 13 states and DC. So from a state's perspective, like the commissioner's, they're saying, well, who's going to pay for this type of investment in technology to enable this? And that's just, like, one kind of fundamental question. Like, who's going to pay for it? And then how quick can some of these utilities get their act together to be able to allow this market to occur? So everyone's at different stages in regards to their technology, people, and processes. So it's just going to be a very challenging order, I think, to execute. But it's going to create a lot of discussion and maybe changes in plans.

MARK K: Mm-hmm. Sure.

ELIZABETH COOK: It'll be disruptive.

MARK K: Right. Right.

ELIZABETH COOK: It could create some great things.

MARK K: So just to kind of conclude here, I know you're an active-- an act-- an avid reader from your posts on LinkedIn and our discussions. Are there any books you would recommend for engineers and professionals that are taking this course that might-- they might add to their libraries?

ELIZABETH COOK: Yeah. I was-- I brought-- I brought the books nearby, so--

MARK K: Awesome. [LAUGHTER]

ELIZABETH COOK: I don't know if you'll be able to see them with my virtual background.

MARK K: That's all right. We'll follow up on it in the show notes, for sure.

ELIZABETH COOK: Empires of Light, which is Jill Jones. She's actually local to Pittsburgh. But this is all about the development of the grid in Pittsburgh in the 1880s.

MARK K: Awesome.

ELIZABETH COOK: I think everyone should read that. And then a couple books-- I think The Conundrum by David Owen. And How Scientific Innovation, Increased Efficiency, and Good Intentions Can Make Our Energy and Climate Problems Worse.

MARK K: OK.

ELIZABETH COOK: And then there's another one, The Great Transition: Shifting from Fossil Fuels to Solar and Wind. They're just interesting perspectives, I believe. And then another-- by Lester Brown. And then the other one was The Legacy, David-- I can't say his last name. Can you see it? Or is it too blurry?

MARK K: I can't see it. That's OK.

ELIZABETH COOK: S-U-Z-U-K-I. And it was-- it's about An Elder's Vision for Our Sustainable Future.

MARK K: OK.

ELIZABETH COOK: So I thought they were pretty good in regards to, like, the green initiative. And then the other one, which is more textbook, but I think is a great one and still relevant, is Reinventing Fire by the Rocky Mountain Institute and Amory Lovins. I think that's another--

MARK K: Awesome.

ELIZABETH COOK: I read that one, I remember, on a car ride as I was-- I was-- I wasn't driving, but with a fellow employee when we were driving to MISO. And it kind of both changed our worlds on, like, we could do this. Like, we could do some changes that create a better future.

MARK K: Right. Awesome. Anything in closing that you'd want to add to what we've discussed here for our engineering and energy students.

ELIZABETH COOK: So I think you picked a great class to be in.

MARK K: [LAUGHS]

ELIZABETH COOK: I feel the world of-- I mean, the energy sector in general is-- can open so many doors to so many places, especially if you enter with an altruistic heart. And I think that's what the space needs. You know, open mind, open heart. There's the technologies there. How do we create the mind, shape the minds to really transition us into a future that we all can engage in? And I know that's a little-- you know. But I started this career not really knowing anything about power but having the right mentorship and the right engagement and the right people, really creating a passion within me that I hope that maybe a little bit of this can inspire and help some of the students really come down a path. And you can get a job in any state, any country, because we all need power, so just stay focused.

MARK K: Excellent. Well, Liz, thank you very much for your time, and look forward to chatting again.

ELIZABETH COOK: Yeah.

What is due for Lesson 12?

This lesson will take us one week to complete. Please refer to the Course Calendar in Canvas for specific due dates. Specific directions and grading rubrics for assignment submissions can be found in the Lesson 12 module in Canvas.

- Complete all of the Lesson 12 readings and viewings, including the lesson content

- Participate in the Zoom discussion

- Complete Quiz 9

- Project work - Electricity Market Sensitivities

Questions?

If you have any questions, please post them to our Questions? discussion forum (not email). I will not be reviewing these. I encourage you to work as a cohort in that space. If you do require assistance, please reach out to me directly after you have worked with your cohort --- I am always happy to get on a one-on-one call, or even better, with a group of you.

A Cautionary Tale from Vermont

A Cautionary Tale from Vermont

Before you get into the details of the lesson, please have a look at the following story from the New York Times about wind farms in Vermont: Intermittent Nature of Green Power is Challenge for Utilities [2].

As you are reading the story, think about the following questions (these would apply to solar as well as wind, but since the story is specifically about wind, we’ll pick on wind to frame the questions). Clearly, the integration of wind into the Vermont electric grid (which is interconnected to the rest of the New England grid) has not gone as smoothly as we might have hoped.

- Why does one wind farm in Vermont represent a challenge for ISO New England, which is the RTO that operates the electric transmission system in all six New England states (not just Vermont)? Isn’t this one wind farm too small to have much of an impact, relative to the entire New England power grid?

- What has ISO New England done in response to that challenge?

- How have other generation resources within Vermont or the New England grid been impacted?

- What is the impact of ISO New England’s operational rules and market structures on the financial viability of wind energy in Vermont? Of other generators in New England, given increasing wind penetration in the New England grid?

- Do you see any conflicts or complementarities between ISO New England’s operational rules and the desire of states within the ISO New England footprint to increase their utilization of renewable energy? The tension between RTO rules and state energy policy is a complex legal issue that is affecting many areas right now, not just one small state in New England.

Variable Energy Resources and Three Economic Challenges

Variable Energy Resources and Three Economic Challenges

Please read the “Overview” section (through page 14) from " Managing Variable Energy Resources to Increase Renewable Electricity’s Contribution to the Grid. [11]"

The terms “renewable energy resources” and “variable energy resources” are often used interchangeably when applied to electric power generation. The two are, in fact, not the same, although there is some overlap. The term “Variable Energy Resource” (VER) refers to any generation resource whose output is not perfectly controllable by a transmission system operator, and whose output is dependent on a fuel resource that cannot be directly stored or stockpiled and whose availability is difficult to predict. Wind and solar power generation are the primary VERs since the sun does not shine all the time (even during the day, clouds and dust can interfere with solar power generation in surprising ways) and the wind does not blow all the time. In some cases, hydroelectricity without storage (so-called “run of river” hydro) could be considered a VER since its output is dependent on streamflows at any given moment. VERs are, in some sense, defined in relation to so-called “dispatchable” or “controllable” power generation resources, which encompass fossil-fuel plants, nuclear, and some hydroelectricity (with reservoir storage). The VER concept is pretty vague if you think about it – after all, coal or natural gas plants can sometimes break and so don’t have perfect availability. Fuel supply chains can also be disrupted for fossil plants. In addition, the “variable” aspect is, at least in concept, nothing new for system operators. Demand varies all the time and system operators are able to handle it without substantial negative impacts.

Keep in mind that the “variability” of VERs is different over different time scales. Figures 7-9 of “Managing Variable Energy Resources to Increase Renewable Electricity’s Contribution to the Grid” show how wind and solar are variable over time scales of days or fewer. Figure 12.2, below, shows wind energy production in the PJM RTO every five minutes over a period of two years. This figure shows how wind production varies seasonally and also inter-annually, with windier and less windy years.

Variability with respect to electricity demand is also important. If you think about it, electric system operators don’t really care about variability in demand or in VERs per se – what they care about is being able to match supply and demand on a continuous basis. If variability between VERs and demand were perfectly synchronous, so that VERs would increase (or decrease) in output right at the moments when demand increased or decreased in output, then there would be no problems. If VERs and demand are anti-correlated or perfectly asynchronous, that poses more of a challenge. Part of the challenge with the wind in Vermont, as you have read, is that the wind tends to blow most strongly at night when there is less electricity demand and the power plants that are serving that demand are inflexible “base load” units that are difficult to ramp down. This is typical of wind – Figure 12.3 shows (normalized) wind and electricity demand by season in the PJM RTO. Solar, on the other hand, is much more highly correlated with electricity demand (at least on a day-to-day basis).

Whether or not you believe that there is anything “special” about VERs, electric grid operators around the world are rethinking the way that they plan and operate their systems and markets in order to accommodate various forms of policy that are promoting investment in VERs. Read the introductory portion of Chapter 4 of Energy Storage on the Grid and the Short-term Variability of Wind and pp.15-20 of “Managing Variable Energy Resources to Increase Renewable Electricity’s Contribution to the Grid,” which discuss various types of strategies that grid operators have been using to manage large-scale VERs on the grid. As you may have gathered from the Vermont article, some of the control strategies used most often by grid operators (such as manually curtailing wind energy output during periods when supply exceeds demand) have also been the most controversial.

More generally, there are three economic challenges relevant to VER integration, each of which we will discuss in a bit more detail.

- VERs tend to depress market prices for electric energy, sometimes even producing negative prices. These negative prices make some economists cringe but are completely sensible in the world of electricity. Remember from Lesson 11 that the Locational Marginal Price (LMP) at a specific location in the grid reflects the cost of delivering electricity to that location. If there is more demand than supply at a given location and the transmission grid is constrained, the LMP at that location will be high. But if there is more supply than demand at a given location, which could happen when there is more wind or solar energy produced than the grid can absorb, then the opposite effect happens with the LMP at that location and the LMP will become negative. This is good for consumers, but not so good for power producers (both conventional generators and VERs). While this has certainly been a challenge for states in the U.S. that have seen rapid growth in wind and solar (primarily California and Texas), it is by no means a challenge specific to the United States. Germany, which has been very aggressive towards a renewable power generation transition, has seen a rise in the frequency of negative prices [12], which is great for consumers (hey, you get paid to use cheap green electricity) but terrible for power generation companies. A solution to this challenge in some areas has been to establish “capacity” payments that are designed to make generators whole financially and keep power plants from retiring too early. You can see a nice animation of electricity prices, including when prices go negative, in this picture for the Texas grid, known as ERCOT [13].)

The emergence of low-cost solar photovoltaics and energy storage presents an additional challenge to the business models of electric utilities. This is more complex than the disruptive competition that new technologies can generate, because the electric utility has a regulatory mandate to provide universal service at high reliability. If solar PV and energy storage steal business from the utility, then the social question arises of whether we find ways to continue to pay for the electric grid (for those who continue to depend on electric service from the grid) or whether we abandon the utility's social mandate to ensure electric reliability. You can read more about this in the report The Economics of Grid Defection [14] from the Rocky Mountain Institute. - Fluctuations in VERs can sometimes happen too quickly for system operators to respond manually, so automated response systems are required. These are generically termed “ancillary services.” The economic challenge is that VERs increase the demand for ancillary services and probably require the establishment of new types of ancillary services.

- Part of the reason that the first two challenges exist is because demand for electricity is treated as being “inelastic” or unresponsive to price. Designing a financial mechanism that matches demand with VER production is a major potential application of “smart grid” systems. For now, electricity markets have opened programs for “demand response,” which offer payments to customers that are able to adjust demand quickly.

Capacity Markets

Capacity Markets

Many restructured electricity markets offer power generators payments for the capacity that they have ready to produce electricity, not just for the electricity that they actually produce. For example, if you owned a 100 MW (100,000 kW) power plant and the capacity payment was $10 per kW per month, you would earn $12 million per year regardless of how much electricity you actually produced. In areas that have them, capacity payments have become a major portion of a generator’s revenue stream.

Capacity markets are a little bit odd. Almost no other market for any commodity, anywhere in the world, has them. (There is a capacity market for natural gas pipelines, but it is operated differently than electricity capacity markets.) In markets for other non-storable goods, like hotel rooms and seats on airplanes, any fixed costs of operations are rolled into the room rate or ticket price. If there is enough unused capacity, then it will exit the market (the hotel will close, or the airline will go bankrupt). Yet, this doesn’t really happen in electricity.

There are three features in electricity markets that have justified the need for capacity markets – two are regulatory interventions. The first goes back to 1965, when a large blackout crippled much of the U.S. Northeast [15] [13]. Rather than being saddled with additional regulations imposed by an angry government, the electricity industry adopted a set of then-voluntary standards [16] [14] for reliability. (The standards are now mandatory.) One of these standards was called the “installed capacity” requirement, which stated that electric grid operators needed to control more capacity than they thought they would need to meet peak demand. For example, if annual peak electricity demand in your system was 100 MW, you might be required to own or control 120 MW of capacity, just in case your power plants broke; your estimate of demand was wrong; or some combination of both. This extra capacity requirement is sometimes called the “capacity margin.”

The second intervention goes back to California’s power crisis of 2000 and 2001. California was one of the first states to deregulate its electricity industry, and it got a lot wrong in the deregulation process. In particular, as firms like Enron found out, the markets created in California were ridiculously simple to manipulate. Prices could easily be driven to levels 100 times higher than normal. Following California’s debacle, other regions did push forward with deregulation, but no one wanted to be the next California. So, virtually all restructured markets instituted “caps” (or upper limits) on electricity prices. In PJM, for example, the price cap is set at $1,000 per MWh. This is the maximum amount that any company may charge for electricity. The markets also instituted watchdogs known as “market monitors” who are tasked with reviewing supply bids submitted by generating companies and flagging those that are deemed to be manipulative. California showed us that electricity markets (even those that are well-designed) are susceptible to manipulation, so many of these market monitors are quite aggressive, punishing firms that submit bids that are higher than marginal costs.

The final regulatory intervention is retail electric rates that are fixed and do not reflect fluctuations in the cost of generating electricity. This has partly been justified on the grounds of protecting consumers from volatile energy prices (the fact is that no energy commodity has more price volatility than does electricity), and also due to the fact that the electric meters that most customers have are still based on a century-old analog technology that does not allow the utility to bill customers based on time of use.

So, suppose that the electric system operator decided that a new power plant needed to be built “for reliability” (i.e., in order to meet the installed capacity requirement). In a market environment, all you would need is for someone to build the plant, operate it during times of peak demand when prices are relatively high, and rake in the dough. Sounds simple enough, right?

Figure 12.4 shows why, in fact, the situation is not so simple. The figure shows the average cost of producing one megawatt-hour from a new natural gas power plant (the “levelized cost of energy,” which we will meet in detail in a future lesson), as a function of how often the plant operates. The more hours the plant operates, the more productive hours over which it can spread its capital cost, so the lower price it would need to charge in order to be profitable. A typical power plant that would operate only during the highest-priced hours would need to charge a price higher than the price cap in order to remain financially solvent. Furthermore, consumers buying energy from that plant would pay the fixed retail rate, not the plant’s levelized cost of energy.

Figure 12.4 basically illustrates the conundrum: someone needs to build the plant for reliability reasons. But because of price caps and fixed retail pricing, no one would ever make money operating this plant. We are stuck in a contradiction – the system operator needs to maintain its installed capacity margin, but no power generation company has any incentive to build the plants that will meet this regulatory requirement.

In electric systems that have not restructured, this isn’t so much of a problem since the regulated utility can ask its public utility commission to pass through the costs of this plant to its ratepayers. But in a deregulated generation environment, there is no guarantee of cost recovery. This conundrum is sometimes called the “missing money” problem. Capacity payments are supposed to solve this problem by providing additional revenue to power plants to keep them operating. It is important to realize that capacity payments have been incredibly controversial since they are sometimes viewed as windfall profits for power generators.

To see the relevance to VER integration, let’s take our example of the uniform price auction from the previous lesson. In that example, we have five generators and demand is 55 MWh. Generator D clears the market and the SMP is $40/MWh. Profits are:

- Firm A: $300

- Firm B: $375

- Firm C: $200

- Firm D: $0

- Firm E: $0

You can see how Firm D might have a “missing money” problem since it produces electricity but earns no profits. If Firm D is the “marginal generator” too often, it will not be able to cover any fixed costs and will eventually go out of business. (We didn’t have fixed costs in the example, but most power plants do have some fixed costs of operation, like land leases or other rental payments.)

Now suppose that a 20 MW wind plant was built in this market. Wind energy has a very low marginal cost – so close to zero that we can just call it zero for this example. This new wind energy plant moves the entire dispatch curve to the right by 20 MW. If the wind is producing at full capacity and demand is 55 MWh, then Firm C becomes the market-clearing generator and the SMP falls to $30/MWh. (The 20 MW of wind with zero marginal cost has the same effect on Firms A through E as a 20 MW decline in electricity demand – why?) Try recalculating profits yourself under this scenario. You should get:

- Firm A: $200

- Firm B: $225

- Firm C: $0

- Firm D: $0

- Firm E: $0

- Wind Farm: $600

While it is nice that the wind farm’s profits are so high and that the wholesale price of power has fallen, three of the five existing generating firms are not making any profit and might consider shutting down altogether. But according to reliability rules, we need those plants to be operating in order to have enough bulk generation capacity. Because of this requirement, the wind farm has effectively instigated a “missing money” problem for some of the other generators in the system. Hence, there is some need for a capacity payment or other revenue stream, but only because of the regulatory requirements for installed capacity.

To figure out what the capacity payment needs to be for a specific generator, we can compare its revenues to its total costs. The difference represents the capacity payment needed for the power plant to break even. Consider two cases as an illustration. First, suppose that Firm C in our example above had fixed costs of $100. With the wind plant in the market, Firm C breaks even on its operating costs (the SMP is $30 per MWh and its production cost is also $30 per MWh) but covers zero of its fixed costs. So, the capacity payment needed for Firm C would be $100. As a second example, suppose that Firm A had fixed costs of $250. With the wind plant in the market, Firm A earns $200 in operating profit, but its fixed costs are $250. Its total profit would thus be -$50 and Firm A would need a capacity payment of $50 in order to break even.

Finally, suppose that Firm B had fixed costs of $100. With operating profits of $225, Firm B earns a total profit of $225 - $100 = $125. Thus, Firm B is profitable even without a capacity payment. Does that mean that Firm B is not allowed to earn a capacity payment in the electricity market? No - Firm B can compete in the capacity market and earn a capacity payment just like any other power plant. While the capacity market was set up because some power plants (like A and C in our illustrations) have revenue shortfalls, participation in the capacity market is not limited just to those plants who "need" a capacity payment to avoid losing money.

You might be wondering what happened to the 20 MW of new wind – doesn’t that count as “capacity?” The answer is that different regions have very different ways of allocating capacity credits to VERs. Typically, the system operator will let a VER count for a fraction of its capacity. So, our 20 MW wind farm in this example would count for perhaps 2 or 3 MW towards the system-wide installed capacity requirement.

In some areas with a high penetration of VERs, particularly wind, the price of electricity has started to become negative, meaning that suppliers must pay the system operator in order to keep producing electricity. This also means that consumers get paid to use more electricity, which sounds like a terrific deal. Here’s how such a thing is possible. Mount Storm Lake in West Virginia is home to both a large coal plant (one of the biggest in the state) and a large wind farm. These plants are connected to the same transmission line that winds its way towards Washington D.C. This transmission line is almost always congested, so the Mount Storm group of power plants cannot always produce at full combined capacity. During an autumn evening, when electricity demand is low, the Mount Storm coal plant is producing at full capacity and meeting electricity demand. All of a sudden, the wind picks up and the Mount Storm wind farm starts to generate a lot of power and there is excess supply at Mount Storm. What options does the system operator have? It could simply shut down the coal plant (which would be hard to do quickly since coal plants are inflexible) or shut down the wind farm (which, as you saw in Vermont, is not without its own problems). Or it could allow the price to go negative and charge either (or both) plants to continue to produce electricity. If there happened to be some electricity consumer at Mount Storm, that consumer could get paid for absorbing that excess supply locally.

Ancillary Services

Ancillary Services

In a power grid, supply and demand must be matched at every second. In order to keep the grid operating reliably, system operators need a portfolio of backup resources in case of unplanned events. These backup resources are collectively known as “ancillary services.” These are purchased by the system operator through a type of option arrangement. The system operator might have an agreement with a power plant that gives the system operator the right to start up or shut down that plant if a contingency arises on the power grid, or if demand increases or decreases in ways that the system operator did not predict.

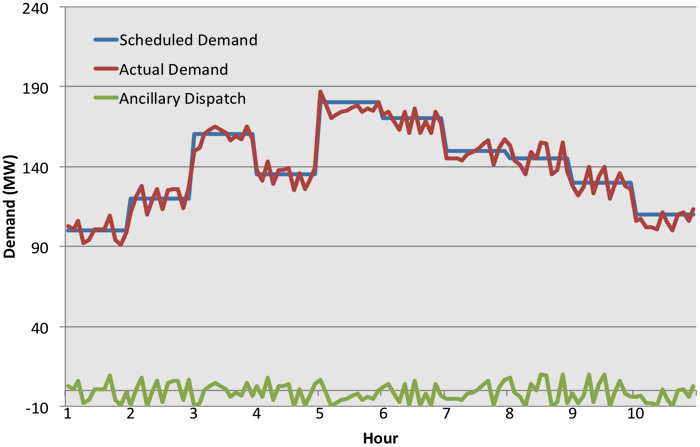

A very simple example of how this might work is shown in Figures 12.6 and 12.7. Figure 12.6 illustrates a hypothetical power system with some amount of predicted or “scheduled” demand. Actual demand deviates from this scheduled demand by small amounts – sometimes higher and sometimes lower. Figure 12.7 shows how a generator providing ancillary services would change its output in response to demand fluctuations – a practice known as “load following.” Ancillary services are the primary mechanisms currently in place for system operators to accommodate unanticipated variations in VER output.

There are many different flavors of ancillary services. Please read the “Ancillary Services Primer” which provides some more detailed information. Two types of ancillary services are of particular relevance for VER integration – reserves and regulation.

“Reserves” represent backup generation that can be called upon in a certain amount of time in case of a contingency on the power grid, like the unexpected loss of a generator or transmission line (interestingly enough, it’s not clear whether or not the unanticipated loss of a VER for resource reasons, like the wind stops blowing, is considered a “contingency” in the eyes of reliability regulators). There are two types of reserves:

- Spinning Reserves: Generation that is synchronous with the grid (“spinning”) and is able to increase power in 10, 30, or 60 minutes (depending on the flavor).

- Non-spinning reserves: Generation that can start up and provide power within a specified time frame (usually 30 or 60 minutes).

“Frequency regulation” or just “regulation” refers to the generation that can respond automatically to detected deviations from the frequency at which all generators in a synchronous AC system are rotating (in the US, this is 60 Hertz; some other countries use 50 Hertz). Regulation is sometimes called “automatic generation control” since the response is typically too fast for a human being to initiate.

Regulation is, at this point in time, the most relevant ancillary service for VER integration and is also one of the most difficult to understand. The frequency of the power grid needs to remain constant at 50 or 60 Hertz (depending on the country). That frequency is related to the demand-supply balance. It may be helpful to think about frequency as analogous to the water level in a bathtub, as illustrated in Figure 12.8. The balance of demand and supply is like the tub having an identically-sized faucet and drain. If the faucet is larger than the drain, the water level rises – and in a power grid if the supply is larger than the demand, then the frequency will go up. If the drain is larger than the faucet (or if demand exceeds supply), then the system frequency declines.

Frequency regulation as an ancillary service corrects for frequency deviations by increasing or decreasing the output of specific generators, usually by small amounts, in order to effectively increase or decrease the size of the faucet relative to the drain. Response times for generators providing regulation are typically on the order of seconds, which is primarily why frequency regulation is used as a way for system operators to ride through unanticipated fluctuations in VER output.

Demand Response in Electricity Markets

Demand Response in Electricity Markets

Recall from the Ancillary Services discussion that generators are used to provide frequency regulation by effectively increasing the size of the faucet relative to the drain. There is no particular reason that generators need to have a monopoly on this. If we were to change the size of the drain relative to the faucet, we would accomplish the same thing, right?

The idea of balancing supply and demand on the demand side rather than solely on the supply side is not that new – electric utilities have been paying their customers to put timers on thermostats or hot water heaters for decades. Some utilities have even figured out how to charge customers more for electricity during the day than at night. But following an order from the Federal Energy Regulatory Commission in 2012 (Order 745), there has been a renewed interest in developing mechanisms to pay people and businesses not to consume electricity. “Demand Response” refers to end-use customers adjusting demand in response to price signals, or energy conservation during periods of high demand (to prevent blackouts). Many electricity systems, particularly those with active wholesale markets, have implemented wholesale demand response programs that allow customers to offer demand reduction on the same basis that generators offer supply. There are two basic flavors of demand response:

- “Economic” Demand Response: You make a negative supply offer to the system operator, and you can then be “dispatched” to reduce demand. The system operator then pays you for reducing demand, relative to some measured “baseline.”

- “Capacity” Demand Response: You give the system operator the right to call upon you to reduce demand during reliability emergencies; typically on hot days during the summer.

Many electricity systems, both regulated and restructured, are also experimenting with allowing demand-side participants to offer ancillary services such as frequency regulation (remember the bathtub analogy and you will see that, at least in concept, this is a perfectly sensible idea). But to date, the vast majority of demand-side participation, and over 90% of all of the profits from demand response, has been through the capacity market. Figure 12.9 illustrates the rapid growth in demand-side capacity market participation. In recent capacity auctions, the largest source of new “capacity” was actually commitments to reduce demand rather than increase supply. This figure shows how the components of the PJM Base Residual Auction (BRA) for installed capacity (ICAP) changed over the years 2007-2015. The left side of the figure shows the components of capacity reductions in the form of retirements, derates, et cetera. The right side shows the components of the capacity additions in the form of new generation, demand response, et cetera.

The result has been to introduce volatility into capacity market pricing. Just as the introduction of VERs lowered the price in the electricity market in our previous example, so too has demand response lowered prices in the capacity market, to the point where generators have started to complain of a “missing money” problem in the capacity market as well!

The primary piece of regulation that has enabled demand response in electricity markets is known as FERC Order 745 [17], which mandated that Regional Transmission Organizations compensate demand response at the prevailing market price under most conditions. This means that if you successfully offer electricity demand reduction to the RTO, you benefit twice. First, you benefit by not having to pay for the electricity that you did not consume. Second, you benefit because the RTO pays you the prevailing market price for all of that foregone consumption.

Because of the way that Order 745 has mandated that demand response be paid, it has been very controversial, so much so that it was successfully challenged in May of 2014 before the U.S. Circuit Court in Washington, DC. You can read the entire ruling here [18], but the gist of the arguments against Order 745 were as follows:

- Paying demand response the prevailing market price is arbitrary and not justified by the value that it provides to the market;

- Because demand response market participants are retail electricity customers, connected to the low-voltage local distribution grid, the U.S. federal government has no jurisdiction to set prices for those customers. Instead, that is the responsibility of the states.

The D.C. Circuit Court agreed with both of these arguments and overturned FERC Order 745, effectively removing economic demand response as a participant in U.S. electricity markets. In a moment that captured the attention of electric power industry geeks everywhere, the D.C. Circuit Court decision was appealed to the U.S. Supreme Court [19], which overturned the Circuit Court decision [20] and allowed demand response to be paid the same way that power plants get paid. If you happen to be a legal junkie, you might like to read the Supreme Court's decision [21], which has had implications for a lot of different smart grid technology programs run by regional power markets.

Lesson 12 Summary and Final Tasks

Lesson 12 Summary and Final Tasks

Variable Energy Resources (VERs) - specifically wind and solar - do introduce some special economic challenges to power grids and electricity markets. Since VERs have such low marginal costs (remember that fuel from the wind and sun is free) they do have the potential to depress prices in the day-ahead and real-time energy markets, even producing negative prices in some cases. This creates challenges for system operators in restructured areas in particular, since they are charged with having enough generation capacity on the grid to meet reliability requirements, but individual generation owners will stay in the market based only on business criteria - whether they earn enough money to make continued operations worthwhile. The resulting conflict between market and regulatory signals has been called the "missing money" problem, and capacity payments have been introduced, albeit controversially, as a mechanism to make up for the "missing money." Energy output from VERs can also fluctuate faster than system operators are able to adjust for, so large-scale VER integration will almost certainly increase the demand for existing ancillary services (particularly frequency regulation) and may necessitate new types of ancillary services, which could be provided by either demand-side or supply-side resources.

Reminder - Complete all of the Lesson 12 tasks!

You have reached the end of Lesson 12! Double check the What is Due for Lesson 12? list on the first page of this lesson to make sure you have completed all of the activities listed there before you begin Lesson 13.