Reading Assignment

For this lesson, please read the sections entitled "Externalities - A Failure to Account for All Costs and Benefits," "External Costs," and "External Benefits" in Chapter 5 - "Difficult Cases for the Market."

“Externalities” are the last type of market failure we will talk about. They are a form of free entry/exit market failure. When a trade is made, there are normally two people affected by the trade: the buyer and the seller. But, sometimes, a trade or some other piece of economic activity has an effect on people who are not directly involved. Because these effects are on a person who is external to (or outside of) the trade, we call them externalities. Externalities can be either positive or negative; that is, the economic activity of one person or group can have either a positive or negative "spill-over" onto other people.

- An externality is when the welfare (utility) of a person depends not only on his activities, but also on the activities of an “outside” person.

- This occurs when property rights are NOT well-defined.

Examples of externalities:

Pollution

This is the most common type of externality, and the one that will be addressed most frequently in this course and in real life. It can take many guises. For example, think about a case where a village makes its living from catching and selling fish from a river. Now, if a chemical plant opens 25 miles upriver and decides to discharge chemical waste into the river, then the fish all die and the people in the village lose their ability to make a living. In this case, the chemical plant (and, by extension, its customers) is not being forced to cover all of the costs of its operation. If it was required to dispose of hazardous waste in some way that did not involve dumping it into a river, then it would be faced with higher costs, and if it has higher costs, then the price of its products will be higher. If the price is higher, then consumers will purchase less.

Air Pollution

Air pollution is one of the key externalities that has been addressed in the US over the past 40 years. In the Industrial Heartland of the US - places like Michigan, Ohio, and Pennsylvania - a lot of industrial facilities have burned coal over the past 150 years. The coal that is burned in these power plants, steel mills, and factories contains sulfur. When sulfur burns, it forms a compound called Sulfur Dioxide, SO2. The SO2 is carried into the environment by the exhaust stacks connected to the boilers of these plants. When the SO2 mixes with water vapor in clouds, it forms Sulfuric Acid, H2SO4, and eventually, this falls as part of rain. This is what is known as Acid Rain, and was responsible for lowering the pH of many lakes and rivers in the north-eastern part of the United States to the point where these bodies of water were unable to sustain any life. Another form of air pollution comes from the burning of gasoline in motor vehicles, which gives us several undesirable compounds: unburned hydrocarbons and partially reacted oxygen, in a form called ozone, which, in the presence of sunlight, creates photochemical smog, which can be severely damaging to the lungs. We also get particulate emissions - another word for soot - which consists of very fine particles of partially burned hydrocarbon that float in the air and get inhaled by people, and we also get Carbon Monoxide, a poisonous gas that can cause nausea at low concentrations and death at not so high concentrations. These emissions have all been the target of environmental legislation over the past 40 years, and we will talk at length later of attempts to regulate them.

Water Pollution

A common form of water pollution is runoff of fertilizer from fields. In the central part of the US, known as the "Bread basket" (think of places like Illinois, Iowa, Kansas, and so on), farmers use a great amount of chemical fertilizer to ensure large crops of corn and soybeans. Since fertilizer is relatively cheap, farmers have an incentive to over-apply, as opposed to under-applying it. Any fertilizer that is not absorbed by the plants runs off with rainfall into rivers, and these rivers all end up flowing into the Mississippi River. As you go downstream, the concentration of the Mississippi river increases. The result is that in the Gulf of Mexico, just off the coat of Louisiana, there is a large "dead zone' several hundred square miles in size which is caused by the excess fertilizer in the water. This fertilizer accelerates the growth of algae in the water, and the algae consumes all of the oxygen in the water, meaning that nothing else can live in the water. One of the reasons that the damage from the recent oil spill in the Gulf was not larger was that it occurred in this "dead zone," so there was not a lot of marine life to kill to begin with. This situation creates a benefit for everybody who consumes corn or soybeans - which is, basically, all of us, in the form of cheap food, but it has a significantly negative effect on the biodiversity of the Gulf of Mexico, with secondary effects that are scarcely understood by humans.

Bees and Crops

This is an example of a positive externality: bee keepers take part in a market for honey: they raise and keep bees in order to harvest honey and sell it to the public. In the process of creating honey, bees fly around and pollinate plants, which enables them to grow. This is very beneficial to people who grow flowers and vegetables for a living. Without bees, these vegetable or flower growers would have to manually pollinate their plants - a very tedious and labor intensive process, or develop hybrid plants that are self-pollinating. These are both costly propositions. Indeed, these businesses rely upon the presence of bees to enable their business models to work - without them, their products would be more expensive, and thus there would be less consumed. So, the presence of bees to pollinate commercial plants is a positive externality that arises from the presence of honey farmers.

Noise

Pollution does not simply refer to dirty air or water, but it also refers to other bespoilments of the environment, and one of these is noise pollution. Noise pollution can come from a variety of sources: highways, airports, factories, construction sites, nightclubs, railroads (I live close to a railway level crossing, and the sound of sirens and horns as the trains pass the crossing several times a day can be very annoying. Fortunately, one grows accustomed to this noise, and after a while, you don't really hear it.) It is basically another by-product of economic activity, and if the noise was forced to be reduced in some way, then the firms generating it would have one of two choices: reduce the amount of economic activity (this is common, such as airports being forced to be closed overnight), or install expensive equipment to reduce the amount of noise emitted. Once again, this has the effect of raising costs, and the raising of costs means that the equilibrium price is higher, and there will be less consumed. Sometimes the economic activity gets shut down completely - for example, a lot of bars and clubs in New York City have been forced to close because the buildings they occupy have become residential areas, and the clubs get fined for excessive noise so frequently that they are unable to continue doing business.

There can be positive and negative externalities, but since positive externalities do not present a large economic problem, economists concentrate on negative ones - positive externalities do not really present much of a market failure issue.

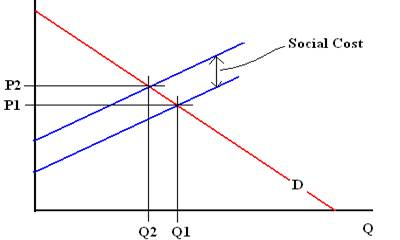

The general issue here is one of costs: there are costs that are borne by the participants in the economic transaction, and then there are costs that are borne by non-participants - the external costs. The costs that the participants bear - the costs to the seller that are transferred to the buyer via the price mechanism - are what we call "private" costs. In an ideal world, all economic costs will be private - they will be all borne by the people who derive utility from the transaction. However, in reality, there are many cases where there are some costs that are transferred to non-participants - such as fisheries destroyed by acid rain, or the ill-health that comes from breathing dirty air, or the problems of trying to sleep near noisy factories or railroads. These costs, which are not carried by the manufacturer or purchaser of the goods in question, are what we call "social costs," because they are borne by society. They are illustrated in the following supply and demand diagram:

In the above diagram, we have the "private" equilibrium, which is the intersection of P1 and Q1, and we have the "social" equilibrium, which is the intersection of P2 and Q2. The difference between these two equilibria comes from the upward shift of the supply curve when we include the social costs, which are costs that are paid by society in general, or by people "external" to the transaction, versus the private supply curve, which is the one that contains all the private costs.

I may be over-simplifying things here, but, basically, the entire field of environmental economics is concerned with trying to shift the equilibrium from the private one, (Q1, P1), to what we call the "socially optimal" equilibrium, (Q2, P2). This is often referred to as "internalizing" an externality.

In the next lesson, we will discuss methods for performing this shift, how these methods are implemented, and how effective they are.

What is not an externality?

When we talk of one person's actions affecting another person negatively, we sometimes hear about something called a "fiduciary externality." This can be boiled down to the following: if one person buys a good, they are moving the demand curve outwards. This act of moving the demand curve outwards will result in movement of the equilibrium to a point where the price will be higher than it would be without that person buying. Put another way, if I buy a good, you cannot buy it, and if you want to buy it, you may have to pay a higher price. This is most obvious in an auction scenario. Just last night, I was watching an auction for exotic cars, and, in one case, there were two bidders for a certain vehicle. Each person kept increasing their bid, that is, causing the other person to pay more. This is not a market failure. Another example could be travel at Thanksgiving: because more people want to fly, and because the number of airplanes is finite, fares tend to increase over Thanksgiving. Similarly, more people want to drive over this period, and thus roads are more congested (and thus, the opportunity cost of using them increases.) These are all situations where increased demand raises prices, so that any one person is adversely affected by everybody else's economic choices, but this is not an externality in the sense that it is not a market failure - it is merely a dynamic realignment of the market equilibrium as a response to a temporary change in demand, much like the fact that roses are more expensive on February 14th than they are on February 21st, gasoline is more expensive around Memorial Day than around Columbus Day (ceteris paribus), and hotel rooms are a lot more expensive at Rehoboth beach, DE in July than in November. I reiterate: these are not market failures, except in cases where market power comes into play, but that is a separate issue.